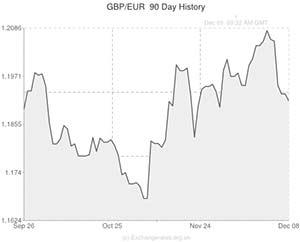

The Pound continued to fly high at the start of last week before seeing some of its strength peeter out as it came to a close. The ongoing positive picture for the UK economy has seen demand for British assets remain high and pushed Sterling to multi-year highs against a number of its peers.

At the start of the week the currency continued a rally against the US Dollar which lasted for a fifth consecutive day against and saw the Pound reach its highest level since 2011. The currency also managed to make a fourth-day of gains against the Euro continuing to trade above the 1.20 level. Sterling received a further boost in Monday’s session after a Manufacturing PMI report came in at its highest level since February 2011. The PMI reached the 58.4 level. Any number above 50 indicates expansion.

On Tuesday the currency came close to a fresh two-year high against the US Dollar after Construction PMI data for November came in significantly higher against its peers. UK construction achieved 62.6; up from the previous month’s 59.4 and better than the 59.0 forecast. Against the Euro, Sterling came close to its highest-level since January.

Midweek the currency softened slightly against the Euro and other peers after Markit’s Services PMI came in softer-than-expected. The data showed that the services sector expanded for an 11th consecutive month in October and was the highest figure recorded since 1997. Despite all that the figure disappointed the market as it came in below economist expectations.

As the week progressed Sterling softened for a third day against the Euro after the Bank of England maintained interest rates at the record low level of 0. 5% and as UK Chancellor George Osborne unveiled his autumn statement. The currency ticked higher briefly after Mr. Osborne revised the nation’s economic outlook higher for next year.

As the week drew to a close the Pound made its biggest weekly decline against the Euro since October due to the Bank of England’s decision to maintain interest rates. The Euro managed to make gains after the European Central Bank gave no hint that it was planning on introducing negative rates. The pound also slid to one-week low against the U.S. Dollar following the release of strong U.S. economic reports which supported demand for the ‘Greenback’.

For the week ahead the Pound is likely to continue to trade firmer against its peers. If the week’s spate of economic data releases continue to come in strongly than the currency could push higher. Disappointing data out of the Euro would also likely see the Pound firm higher to push to the 1.20 mark.

Against the commodity based currencies such as the Australian, New Zealand and Canadian Dollars the Pound looks likely to stay close to multi-year highs as speculation over whether the US Federal Reserve will taper its monetary easing programme continues.

Key events for the week ahead

Tuesday December 10th 2013 – Industrial Production YOY

Balance of Trade

Manufacturing Production

NIESR GDP estimate

Friday December 13th 2013 – Manufacturing Production

Current Pound Sterling (GBP) Exchange Rates:

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6376

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.1934

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.8031

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.977

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6106

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8378

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5545

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5055

(As of 10:10 am GMT)

Comments are closed.