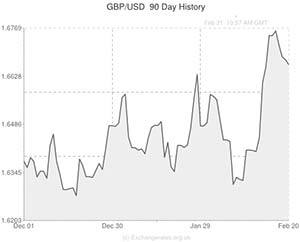

The Pound is forecast to make gains against the US Dollar and push higher over the course of the weekend after data showed that sales of existing homes in the US fell in January to the lowest level in more than a year.

According to the National Association of Realtors, the number of existing home purchases fell by 5.1% to just 4.63 million at an annual rate in January. Economists had been widely expecting a drop to 4.67 million. The report added that sales fell in all four regions of the USA.

The data caused some economists to blame the extreme weather that had hammered parts north America over the past few months. Others say that the fall could be a result of higher borrowing costs and higher property prices.

“It’s hard to separate the weather effect from the fundamentals, but housing is still reasonably healthy here in recovery mode. Maybe some of the strength we saw in the latter part of last year was a little overdone and there may have been a bit of a correction anyway, and weather exacerbated that,” said a chief economist.

After the data was published the ‘Greenback’ fell against the Euro.

Sterling pushed higher earlier in the session despite reports showing that retail sales in the country fell more than expected last month. The UK also saw a smaller than forecast budget surplus. The data did little to harm the Pound or investor confidence that the nation’s economic recovery remains on track.

US Dollar (USD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

US Dollar, ,Pound Sterling,0.5999 ,

,Pound Sterling,0.5999 ,

US Dollar, ,Euro,0.7289 ,

,Euro,0.7289 ,

US Dollar, ,Australian Dollar,1.1161 ,

,Australian Dollar,1.1161 ,

US Dollar, ,Canadian Dollar,1.1150 ,

,Canadian Dollar,1.1150 ,

Pound Sterling, ,US Dollar,1.6670 ,

,US Dollar,1.6670 ,

[/table]

Comments are closed.