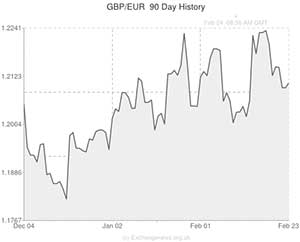

The direction of the Pound to Euro exchange rate (GBP/EUR) is likely to be dictated by the Eurozone’s latest Consumer Price Index data this week. Mario Draghi, President of the European Central Bank, says that he is ready to act if deflation worries persist.

The Eurozone’s rate of inflation during January is set for release at 10AM this morning; the CPI report is expected to show that price pressures remained weak at 0.7% last month. Any score below 0.7% could have serious consequences for the Euro exchange rate because it would most likely lead to increased speculation that the ECB will introduce further stimulus measures.

However, the most important event on the economic calendar this week is likely to be February’s CPI estimate, which is released on Friday morning and could have a significant impact on the Pound to Euro exchange rate (GBP/EUR).

During a Group of 20 meeting in Sydney yesterday, ECB President Mario Draghi said that the Central Bank is “willing and ready to take action” if Eurozone inflation were to weaken significantly.

The President said the currency bloc was showing tentative signs of recovery, but stressed that further progress is by no means guaranteed. Draghi also noted that, at this moment in time, he sees no evidence of deflation:

“We don’t have any evidence of people postponing their expenditure plans with a view to buying the same thing at lower prices, in other words we don’t see what is defined to be deflation”.

However, Draghi admitted that the Bank’s next policy meeting on March 6th could yield further stimulus if inflation expectations are not firmly anchored around the 2.0% target in the medium term.

During the meeting the ECB will publish its projections for 2016 inflation for the first time; Draghi stated that this report will give him “the full set of information needed for deciding whether to act or not”. Whilst February’s CPI result will not be the only data factored into the equation: it could prove to be the deciding influence. Therefore it is entirely possible that the Euro could decline against Sterling if Friday’s inflation report underwhelms.

Also on the agenda this morning is a set of reports from the IFO institute in Munich, detailing how confident German businesses are in February. The headline Business Climate index is expected to decline mildly from 110.6 to 110.5, whilst the Current Assessment indicator is predicted to rise slightly from 112.4 to 112.8. A series of on-target results are unlikely to have a huge impact on GBP/EUR trading, however, a strong deviation to the upside could give the Euro a boost. Conversely, a soft reading could place downward pressure on the single currency.

Comments are closed.