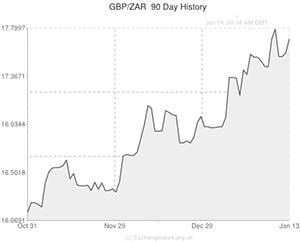

The Rand began Tuesday languishing close to a five-year low against the US Dollar and trading lower against major rivals like the Pound.

With the threat of domestic platinum strikes and potential US tapering quashing the Rand’s appeal, the expectation that today’s mining production report would reveal a slowing in output piled additional pressure on the Rand.

Whether or not the workers of South Africa’s platinum mines will strike over pay will be decided this week as members of the Association of Mineworkers and Construction Union gather to debate the issue.

According to strategic researcher Mohammed Nalla, ‘Labour unrest rears its head again. The Rand seems intent on moving toward 11 per Dollar as importers continue to scramble for Dollars and exporters are quite happy to sit on the sidelines.’

Similarly, analysts from the Rand Merchant Bank commented; ‘The Rand has come under renewed pressure, thanks to a combination of local negatives and further spill-overs from [political unrest] in Turkey. Sentiment is extremely negative and the risk of ongoing rand losses is obvious.’

It was expected that today’s mining data would show that the pace of output declined in November, slipping from the gain of 22 per cent recorded in October to 7.1 per cent.

However, the report showed that mining production increased by just 5.1 per cent year-on-year following an unexpected monthly decline of 2.9 per cent.

The concerning data indicates that South Africa’s export industry has so far failed to benefit from the Rand’s lower exchange rate.

During European trading the Rand’s bearish relationship with the Pound was exacerbated by the news that UK inflation finally slowed to the Bank of England’s 2 per cent target in December.

The first 2 per cent inflation reading for four years helped the Pound rally against its rivals and the British currency received additional support from the expectation that Friday’s UK retail sales report will show an increase in sales.

Tomorrow’s South African manufacturing PMI and retail sales figures will also be of interest.

The PMI came in at 52.4 in November, just above the 50 mark separating growth from contraction, and economists are anticipating a reading of 53.42 for December.

Meanwhile, retail sales are forecast to have climbed by 1.0 per cent year-on-year in November following October’s 1.3 per cent gain.

Current South African (ZAR) Exchange Rates:

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.8115 ,

,South African Rand,17.8115 ,

Euro, ,South African Rand,14.8406 ,

,South African Rand,14.8406 ,

US Dollar, ,South African Rand,10.8110 ,

,South African Rand,10.8110 ,

Australian Dollar, ,South African Rand,9.7068 ,

,South African Rand,9.7068 ,

New Zealand Dollar, ,South African Rand,8.9108 ,

,South African Rand,8.9108 ,

Canadian Dollar, ,South African Rand,9.8768 ,

,South African Rand,9.8768 ,

[/table]

Comments are closed.