Although the Rand climbed to its highest level against the US Dollar so far this year, the currency was a little weaker against the Pound following the release of domestic data.

As the local session opened investors reacted to the dovish Federal Open Market Committee meeting minutes by abandoning the ‘Greenback’ in favour of emerging market assets like the Rand.

The Rand to US Dollar (ZAR/USD) exchange rate consequently advanced, briefly rising to 10.36 Rand per Dollar and its strongest level for 2014 so far.

The minutes assuaged concerns regarding the Federal Reserve hiking borrowing costs in the near future and confirmed that the central bank intends to keep fiscal policy accommodative for as long as necessary.

Absa Capital said this in response to the Rand’s movement; ‘The minutes helped to calm fears surrounding the future pace of Fed tightening, which bodes well for emerging-market currencies like the Rand with large external funding requirements.’

However, the Rand did trim some of its advance as domestic mining and manufacturing data indicated subdued output in spite of the weaker Rand supporting exporters.

In light of recent strikes, mining production plunged by 7.0 per cent in February, month-on-month, following a negatively revised decline of 3.7 per cent in January.

On the year mining production was down by 4.8 per cent.

South African manufacturing production, on the other hand, dropped by 1.9 per cent in February following the previous month’s 0.5 per cent gain.

On an annual basis manufacturing production was up 1.4 per cent.

According to Statistics South Africa, the production of platinum group metals plunged by 36 per cent on the month, the most significant drop for two years.

In the view of BNP Paribas SA the platinum sector strikes are having a serious impact; ‘with inventory levels likely to be wearing thin. We expect this to reflect in the mining production figures over the next three to four months at least and to begin showing up more prominently in the country’s export figures given that PGMs account for around 16 per cent of total exports.’

The Pound meanwhile experienced modest fluctuations following the Bank of England’s rate decision.

As expected by economists, the central bank opted to keep interest rates unaltered and left the level of asset purchases unchanged.

Sterling eased slightly lower against the US Dollar in response to this development and slipped against the Rand.

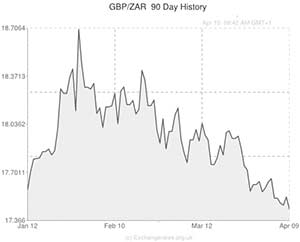

With South African and UK data limited tomorrow any fluctuations in the Pound to Rand (GBP/ZAR) pairing are likely to be the result of global economic developments, including Chinese and German inflation figures and the US University of Michigan Confidence index.

As the Rand tracks the Euro the German report will be of particular interest.

If German consumer prices are shown to have slowed by more than originally estimated (adding to the case for the European Central Bank introducing additional stimulus) the Euro could decline, potentially taking the Rand with it.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,17.3415,

,South African Rand,17.3415,

Euro, ,South African Rand,14.4233,

,South African Rand,14.4233,

US Dollar, ,South African Rand,10.3370,

,South African Rand,10.3370,

Australian Dollar, ,South African Rand,9.8331,

,South African Rand,9.8331,

New Zealand Dollar, ,South African Rand,9.0405,

,South African Rand,9.0405,

Canadian Dollar, ,South African Rand,9.5069,

,South African Rand,9.5069,

[/table]

Comments are closed.