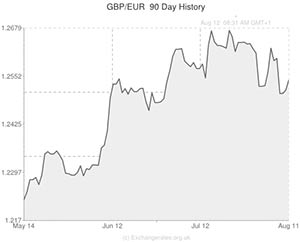

The Pound to Euro exchange rate (GBP/EUR) experienced a rather subdued start to the week as a lack of fresh economic data caused investors to remain on the sidelines.

Fears that the political conflict in Eastern Ukraine could escalate and provoke further sanctions from both sides hurt the Euro yesterday and allowed GBP/EUR to rally by around 0.2 cents to 1.2545. The worst case scenario is that Russia could cut off Europe’s supply of oil and it is the fear of this happening that weighed on the single currency on Monday.

During today’s session it seems that investors will be focussing on the German economic ZEW surveys. The headline economic sentiment index is expected to slide from 48.1 to 41.3, which has the potential to destabilise the Euro. Although the ZEW result may command a more subtle impact on the currency market than it usually does – due to the flurry of high profile economic releases later on in the week – it is still liable to steal the show during today’s lacklustre session.

Things should get a bit more exciting on Wednesday when British labour market data is expected to show that unemployment sunk to a fresh 6-year low of 6.4% but that wages slowed to a 5-year low of -0.1%. Provided the reports print inline with economists’ forecasts, demand for Sterling could recede as rate hike speculation cools.

However, there is potential for the Pound to put in a better performance if the Bank of England’s quarterly inflation report features any distinctively hawkish comments or if it sees the central bank hike its economic forecasts for the next twelve months.

The spotlight will shine on the currency bloc once more on Thursday when Eurostat releases its latest economic growth data. Eurozone GDP is anticipated to have slowed from 0.2% to 0.1% in the first quarter and German growth is predicted to have fallen from +0.8% to -0.1%. The uninspiring data could drive GBP/EUR back above 1.26 if traders are worried by the glaring lack of growth on the continent.

Friday is likely to be focussed on UK data as the Office for National Statistics (ONS) releases its second estimate of second quarter UK growth. The GDP report is forecast to confirm that the British economy accelerated at a quarterly pace of 0.8% and an annual rate of 3.1% between April and June. Any positive revisions will bolster demand for Sterling, whilst anything below the market consensus will have the power to send GBP/EUR clattering back towards1.25.

Comments are closed.