Pound Sterling (GBP)

Following the publication of the latest Bank of England meeting minutes, demand for the Pound increased substantially.

The minutes revealed that two of the nine members of the Monetary Policy Committee (MPC) voted for a rate increase at the beginning of the month; a contrast from last week’s quarterly inflation report which suggested a reluctance to raise rates before wage growth is sufficient.

For the first time in three years the MPC was divided in their opinion on the timing of a rate hike. The dissenters, Martin Weale and Ian McCafferty, argued that the recent positive unemployment rate, paired with rapid economic growth, shows that the British economy is ready for an increased interest rate.

This morning’s UK data may reverse the gains made yesterday. Year-on-year Retail Sales were expected to rise by 3.5% but only registered a 3.4% increase.

Euro (EUR)

Yesterday Eurozone construction output was seen to have contracted by -0.7% in June following the -1.4% decline in May. The soft data shows that the stagnating currency bloc is unlikely to return to meaningful growth in the near future.

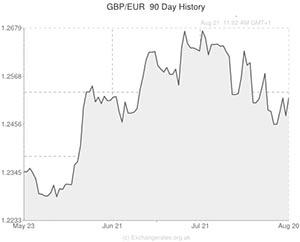

Investors didn’t spend long focusing on this recent negative European data, however, as the Bank of England minutes stole the spotlight. Traders sent the Pound back above psychological resistance at 1.25 versus the Euro as a result of the hawkish dissenting committee members. With the minutes having been scrutinised it is likely that the soft construction data will have a greater impact over the course of the day.

The dwindling Eurozone growth prospects will come under yet more strain if this morning’s manufacturing and service sector data meets with forecast figures. If the expectation of a deceleration in manufacturing and services output comes to fruition the single currency will continue to struggle to claw back against its major peers

US Dollar (USD)

Reaction to the BoE minutes saw the Pound to US Dollar exchange rate rally by around a third of a cent yesterday morning. The gains were short-lived, however, as the evening publication of the latest FOMC minutes showed that Federal Reserve policymakers are content with the current pace of economic growth and labour market progression. The minutes also hinted at the likelihood of a sooner-than-anticipated interest rate hike if economic indicators continue to improve at the current pace.

‘Greenback’ (USD) demand increased significantly following the minute’s publication.

Canadian Dollar (CAD)

Sterling gained around half a cent against the Canadian Dollar yesterday following the revelation that there is a duo of dissenting BoE policymakers.

These gains, however, could prove to be fleeting if Bank of England Governor Mark Carney decides to reignite interest rate confusion with another set of contradictory comments. With this in mind traders were reluctant to push GBP/CAD too high, and the ‘Loonie’ (CAD) managed to gain by the end of the London session as a result.

Australian Dollar (AUD)

Policymakers at the Reserve Bank of Australia yesterday intimated that they are not willing to drop interest rates any lower in order to boost economic standing. Governor Glenn Stevens argued that Australian businesses need to be more hawkish in order to promote economic growth.

The result of the RBA symposium was to see the ‘Aussie’ (AUD) bolstered across the board. The Pound to Australian Dollar found equilibrium yesterday, but the recent UK retail sales data is likely to push back Sterling against most of its peers, including the Australian Dollar.

New Zealand Dollar (NZD)

Sterling gained around half a cent against the ‘Kiwi’ (NZD) yesterday following the publication of the BoE minutes.

The New Zealand Dollar has struggled since Monday’s negative commodity data and the falling dairy sales.

This morning saw New Zealand credit card spending retract by -0.9% in July, and consumer confidence fell by -5.4% in August. The negative data is likely to provoke a continuation of the ‘Kiwi’s downward trend.

South African Rand (ZAR)

Emerging market currencies, such as the South African Rand, will be under pressure from increased speculation of a US rate hike. The Rand is likely to soften if the US manufacturing data produces a positive result.

With no domestic data pertaining to South Africa due for release today; movement for the Rand is likely to be dictated by foreign currency movement.

Comments are closed.