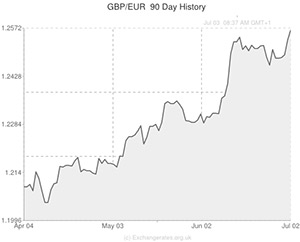

The Pound surged to a fresh multi-month high against the Euro and a fresh multi-year high against the US Dollar yesterday as an outperforming British construction report boosted the appeal of the Sterling currency.

The Pound to Euro exchange rate (GBP/EUR) rose to a 21-month high of 1.2575 in reaction to the sturdy construction report and the Sterling to US Dollar exchange rate (GBP/USD) rallied to a 5.5-year high of 1.7176.

Markit Economics’ latest Purchasing Managers Index showed that the construction sector expanded at its fastest rate for four months during June. Helped by extraordinary job creation and new orders figures the headline PMI came in at 62.6, smashing economists’ predictions of 59.8.

The report detailed how a large increase in new housing and commercial property projects persuaded businesses to hire new workers at the fastest pace on record (the survey began all the way back in 1997). The uptick in job creation was particularly encouraging for the Pound because it suggests that unemployment will continue to fall as we enter the second half of the year.

A separate report showed that UK house prices accelerated at a 9-year high annualised pace of 11.8% during May, and that London prices rose by a staggering 25% on the year.

UK services PMI

Later this morning UK Services activity is predicted to print at 58.3, but if the survey follows the construction and manufacturing reports in exceeding analysts’ expectations then there is scope for even more Pound Sterling gains.

Traders are becoming increasingly confident that the Bank of England will look to cool the UK housing market and foster further growth in the domestic economy by hiking interest rates in November this year. Speculation of this kind is driving demand for the Pound through the roof against the Euro and the US Dollar.

European Central Bank policy

During the afternoon the European Central Bank is due to announce its monetary policy for July: the bank is widely anticipated to refrain from further action because last month’s interest rate cut and deposit rate cuts have not had anywhere near enough time to work their way through the real economy.

However, there is scope for surprise during ECB President Mario Draghi’s post-decision press conference. The ECB Chief is likely to talk up the recent stimulus measures in attempt to calm markets. The threat of deflation does not look as serious as it once did, but the threat of persistently low inflation looks more serious than ever. There is one more policy tool that Draghi has up his sleeve and that’s quantitative easing. If the ECB President opts to discuss the possibility of unleashing a sovereign bond-buying programme then the single currency is liable to suffer steep losses against the Pound.

US non-farm payroll report

Due to the 4th of July celebrations the US trading week is to be cut short this week and subsequently we are in for a rare ‘non-farm Thursday’ as opposed to the usual ‘non-farm Friday’ that markets are accustomed to.

This afternoon’s figure is predicted to print at 215,000, slightly down from the previous score of 217,000. Yesterday’s stronger-than-anticipated ADP employment reading of 281,000 (compared to forecasts of 205,000) has boosted expectations for a sturdy NFP figure. However, the correlation between the two indices is not the strongest and it is entirely possible that the NFP result could print below 200,000 despite the strong ADP numbers.

In light of recent comments from Fed Chairwoman Janet Yellen suggesting that interest rates will remain low even after the QE3 bond-buying programme has been fully wound down, it looks very difficult for the ‘Greenback’ to break the Pound’s dominance at the moment.

Even a NFP score north of 280,000 would struggle to push GBP/USD back below psychological support at 1.7100. On the other hand, a disappointing print sub-200,000 has the potential to drive Sterling towards and beyond the 1.72000 mark.

Comments are closed.