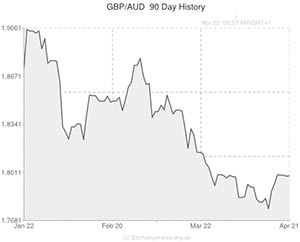

The Pound is currently trading at a monthly high against the New Zealand Dollar (GBP to NZD) and a 2-week high against the Australian Dollar (GBP to AUD) due to last week’s sturdy labour market report.

Sterling soared across the board last Wednesday as data from the Office for National Statistics showed that Unemployment slid from 7.2% to 6.9% and that wages rose by 1.7% during February. The 5-year low jobless rate and the 4-year high Average Earnings figures boosted hopes that a robust period of economic growth in 2014 could persuade the Bank of England to hike interest rates ahead of the current schedule of Q2 2105.

With real wages rising for the first time since 2010 and Unemployment receding rapidly, investors now expect the BoE to raise rates in the first quarter of 2015.

BoE Minutes

Later this week, on Wednesday morning, the BoE will release the Minutes report from its April meeting. The Minutes are expected to show that some policymakers are starting to feel slightly more optimistic with regards to the British economy than they were during March.

If the report reveals that hawkish sentiment is growing rapidly amongst policymakers at the Central Bank then it is entirely possible that the Pound could rally versus its currency peers as rate hike bets proliferate.

Australian CPI inflation

During the early hours of Wednesday morning, prior to the BoE release, the latest Australian inflation data is predicted to show that the Consumer Price Index accelerated from 2.7% to 3.2% during the first quarter. If the result matches the median forecast then it will represent the first time that inflation has breached the Reserve Bank of Australia’s 1-3% target range since 2011.

Traders are likely to buy into the Australian Dollar if this happens because it be seen to increase the probability that the RBA will look to start normalising monetary, via rate hikes, over the next few months.

RBNZ Rate Decision

On Wednesday evening the Reserve Bank of New Zealand will announce its benchmark interest rate for April. Following a 25 basis point increase in March the majority of market players anticipate another 25 basis point rise this time out. This would bring the rate to 3.00% and would therefore offer a much higher yield value than the 0.50% currently offered by the Bank of England.

If the RBNZ does in fact decide to raise rates this month it is likely to give the New Zealand Dollar a sizeable boost against its most-traded currency peers including the Pound.

Comments are closed.