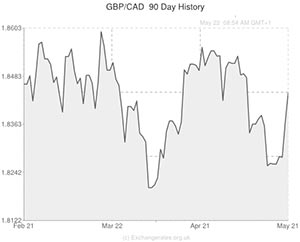

After UK growth figures met estimates the Pound broadly softened and the British asset hit a low of 1.8375 against the Canadian Dollar.

While the GBP to CAD pairing later clawed back some of its losses it continued trading 0.10 per cent lower after Canada’s retail sales report was published.

The commodity-driven ‘Loonie’ was boosted overnight as a gauge of Chinese manufacturing climbed by more than expected.

The HSBC measure advanced to 49.7 in May, just shy of the 50 mark separating growth from contraction.

As currency strategist Adam Cole observed; ‘We took our direction from the Chinese data overnight. When it’s a risk-on move, generally the [safe-haven] Yen is the biggest loser.’

The Chinese report also caused the price of copper to rise and Brent oil to trade close to an 11-week high – both factors which supported the Canadian Dollar.

Then the Pound to Canadian Dollar exchange rate extended declines as investors reacted to the news that the UK economy expanded by 0.8 per cent in the first quarter of the year, in line with expectations.

As investors had been hoping for a positive revision the result saw the Pound weaken. The British currency also suffered as the UK recorded a larger-than-forecast budget deficit.

In the view of economist Samuel Tombs, the UK data does provide ‘more evidence that the economic recovery is based on solid foundations. With a strong rebound in investment enhancing the economy’s productive capacity, the recovery is unlikely to hit the buffers and generate inflation soon.’

Despite this optimistic outlook, the Pound slid against several of its currency counterparts.

During North American trading Canada’s retail sales report showed a 0.1 per cent decline in March.

Economists had expected sales to rise by 0.3 per cent in March.

Sales less autos increased by 0.1 per cent instead of 0.4 per cent, but February’s gain was positively revised to 0.9 per cent.

February’s sales including autos increase was also positively revised to 0.7 per cent – meaning that sales were at a record high before the dip in March.

The Statistics Canada report stated; ‘Sales were lower at motor vehicle and parts dealers and clothing and clothing accessories stores. However, these declines were largely offset by gains at gasoline stations and food and beverage stores. Sales declined in 7 of 11 subsectors representing 59% of retail trade. […] Retail sales were down in five provinces in March. Higher sales in the Western provinces were offset by lower sales in Ontario, Quebec and New Brunswick.’

While the Canadian Dollar remained stronger against the Pound it put on a patchy performance against the US Dollar as reports showed that US initial jobless claims increased by more than forecast in the week ending May 17th.

Separate US data showed an increase in domestic Markit manufacturing PMI, with the measure advancing from 55.4 in April to 56.2 in May.

Tomorrow’s Canadian inflation report is bound to be the catalyst for further Canadian Dollar movement.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5433,

,Pound Sterling,0.5433,

Canadian Dollar, ,US Dollar,0.9163,

,US Dollar,0.9163,

Canadian Dollar, ,Euro,0.6704,

,Euro,0.6704,

Canadian Dollar, ,Australian Dollar,0.9916,

,Australian Dollar,0.9916,

Canadian Dollar, ,New Zealand Dollar,1.0695,

,New Zealand Dollar,1.0695,

US Dollar, ,Canadian Dollar ,1.0904,

,Canadian Dollar ,1.0904,

Pound Sterling, ,Canadian Dollar,1.8415,

,Canadian Dollar,1.8415,

Euro, ,Canadian Dollar,1.4914,

,Canadian Dollar,1.4914,

Australian Dollar, ,Canadian Dollar,1.0087,

,Canadian Dollar,1.0087,

New Zealand Dollar, ,Canadian Dollar,0.9356,

,Canadian Dollar,0.9356,

[/table]

Comments are closed.