The Euro was back on the retreat on Tuesday after a report showed that inflation in the Eurozone slowed more-than-forecast in May, increasing expectations that the European Central will introduce monetary easing measures later in the week.

According to the Luxembourg based European Union Statistics Office, the rate of inflation across the 18-member Eurozone slowed from Aprils 0.7% to 0.5% in May.

The figure is well below the ECB’s target of just under 2% and was the eighth consecutive month that the rate has been less than half the bank’s target.

Further losses for the Euro were held in check as investors widely priced in that today’s data would disappoint.

“This is reinforcing expectations that the ECB will take action at this Thursday’s monetary policy meeting by cutting interest rates and/or introducing a negative deposit rate for banks. The Euro/US Dollar briefly dropped below 1.36 but it hasn’t moved too much as investors already fully expect the Central Bank to take action in two days time,” said a forex trader.

Other data released today took some of the edge off of the inflation report.

Unemployment across the Eurozone fell slightly to 11.7% in April from the 11.8% seen in the preceding month.

The lowest unemployment rate is in Austria with 4.9%, Germany with 5.2% and Luxembourg with 6.1%.

The worst was Greece with 26.5% and Spain with 25.1%.

Eurostat also reported that youth unemployment decreased by 415 000 in the European Union since April 2013, and by 202 000 in the euro area. That leaves 5.259 million people under the age of 25 unemployed in the wider European Union, of whom 3.381 million were in the Euro area.

Further gains for the Pound were limited by the release of a softer than expected Construction PMI report. Markit’s construction PMI ticked down to 60.0 in May, below expectations for a figure of 60.8.

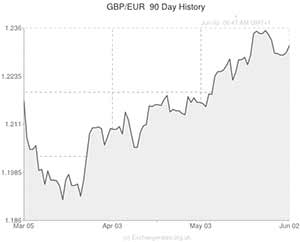

GBP to Euro Update – 04/06/14

The Pound pushed back above the 1.23 level against the Euro on Wednesday afternoon after the single currency came under pressure from nervous investors ahead of tomorrow’s European Central Bank policy meeting.

The US Dollar meanwhile also firmed after it was supported against the Euro from demand for safer assets.

Investors are turning to safer assets ahead of the ECB meeting as the market is unsure as to what measures the ECB will reveal on Thursday. If the banks measures are deemed too weak or too strong then the Euro is likely to weaken against its peers.

The US Dollar fell against the Pound after data showed that the USA’s trade deficit widened sharply in May and as a report showed that job creation in the nation was weaker than forecast.

Comments are closed.