The Euro put on a poor performance on Monday as two less-than-impressive domestic reports took a toll.

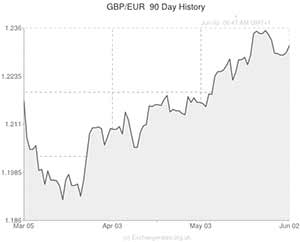

After reports showed that final manufacturing PMI printed lower than originally forecast and German inflation slowed in May, the Euro slid against the Pound and drifted to a 3-month low against the US Dollar.

This morning’s manufacturing index came in at 52.2 for May, down from a previous estimate of 52.5 and softer than the 53.4 recorded in April.

Although the gauge held above the 50 mark separating growth from contraction, the French manufacturing sector returned to contraction territory and the pace of growth eased in major Eurozone nations like Germany and Italy.

Output growth slowed in all Eurozone members other than the Netherlands.

The report stated; ‘France was the weakest performer overall, being the only nation to report a decline in new business and a near-stagnant rate of increase in production. France was hit by weaker inflows of both domestic and new export orders, despite firms’ attempts to shore up demand through discounted prices.’

The Pound, meanwhile, was boosted by the UK’s own manufacturing PMI report. While the measure dipped ever so slightly in May, it continues to demonstrate resilience in the manufacturing sector.

Additional Euro declines occurred after German inflation figures were published.

Germany’s consumer price index declined by 0.1 per cent in May, month-on-month, rather than rising by the 0.1 per cent expected.

On the year the German consumer price index came in at 0.9 per cent.

A reading of 1.1 per cent had been forecast.

This latest report adds to growing concerns regarding the risk of deflation in the Eurozone.

It also supports the case for the European Central Bank introducing additional stimulus when it meets later this week.

In the view of currency strategist Henrik Gullberg; ‘The market is priced for a very dovish ECB policy response. The inflation data remains very subdued. It has reinforced expectations that the ECB will deliver. That has been reflected to some extend in Euro-Dollar.’

Economists are betting that the ECB will cut the deposit rate.

While the prospect of ECB action has largely been priced into the market, if the central bank deploys a mixture of actions or introduces a quantitative easing style scheme, the Euro could ease lower still.

As Monday progressed additional EUR/USD movement was inspired by the US Markit/ISM manufacturing reports.

Markit US manufacturing PMI came in at 56.4, up from a previous estimate of 56.2 and above the 50 mark separating growth from contraction.

Tomorrow volatility in the Euro to GBP exchange rate could take place in response to the UK’s construction PMI and the Eurozone’s inflation report.

Euro to GBP Update 03/06/14

On Tuesday the Euro rallied against the Pound to push send the Pound to Euro exchange back below the 1.23 level.

Sterling was weakened in the morning after a report showed that the UK construction sector saw activity soften in May.

Markit’s construction Purchasing Managers Index fell to a seven-month low of 60.0 last month, easing some of the optimism around the strength of the UK economy.

Despite the dip the figure remained the 50-level which divides expansion from contraction and marked the thirteenth consecutive expansion of activity in the sector.

“Output growth hit a seven-month low in May, but the UK construction sector is enjoying its strongest overall phase of expansion since the summer of 2007,” said a senior economist from Markit.

The Euro meanwhile strengthened despite a report which showed that inflation in the 18-member Eurozone grew by just 0.5% last month, well below the European Central Banks target rate of just under 2%. The data had been widely expected by economists and as such had little negative impact upon the currency.

Instead the Euro found support from a separate report which showed that unemployment across the Eurozone ticked lower in April.

Unemployment in Greece and Spain remains close to record highs of above 25% however.

The Euro could make further gains on Wednesday if the latest Eurozone GDP data comes in as positively as forecast.

Economists are expecting the region’s economy to have expanded by 0.9% in the first quarter of the year. A figure below that however and we could see the single currency give up Tuesday’s gains.

The Euro also rallied away from a three-month low against the US Dollar after traders speculated that the introduction of stimulus measures by the ECB on Thursday won’t be enough to weaken the currency.

“Many short Euro positions are in place,” said the head of foreign-exchange research at Danske Bank A/S. “If the ECB disappoints and perhaps only cuts the refinancing rate, you will see a move higher in Euro-Dollar.” Short positions are bets a currency will weaken.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,Pound Sterling,0.8129,

,Pound Sterling,0.8129,

Euro, ,US Dollar,1.3612,

,US Dollar,1.3612,

Euro, ,Canadian Dollar,1.4832,

,Canadian Dollar,1.4832,

Euro, ,Australian Dollar,1.4738,

,Australian Dollar,1.4738,

Euro, ,New Zealand Dollar,1.6072,

,New Zealand Dollar,1.6072,

US Dollar, ,Euro ,0.7347,

,Euro ,0.7347,

Pound Sterling, ,Euro,1.2306,

,Euro,1.2306,

Canadian Dollar, ,Euro,0.6742,

,Euro,0.6742,

Australian Dollar, ,Euro,0.6785,

,Euro,0.6785,

New Zealand Dollar, ,Euro,0.6214,

,Euro,0.6214,

[/table]

Comments are closed.