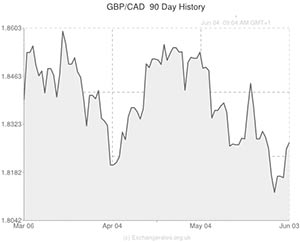

After the Bank of Canada rate decision the Pound advanced on a broadly softening ‘Loonie’.

The Canadian Dollar posted widespread declines in the immediate aftermath of the central bank’s announcement, sliding to a four-week low against the US Dollar and losing ground against the majority of its other most-traded currency counterparts.

As expected by economists, the BOC opted to leave the benchmark interest rate unaltered, hinting that any future interest rate movements will be dependent on domestic data.

Earlier this week Canada’s manufacturing report showed a decline in the nation’s purchasing managers index.

The gauge slid from 52.9 to 52.2.

First quarter growth was shown to have slowed to its lowest level for over 12 months.

Other Canadian reports (including the country’s employment figures) have also been patchy over the last few months, adding to the case for interest rate stability.

After today’s rate decision BOC Governor Stephen Poloz asserted that low domestic inflation remains a major headwind to the economic growth.

Poloz stated; ‘Weighing recent higher inflation readings against slightly increased risks to economic growth leaves the downside risks to the inflation outlook as important as before.’

Earlier in the North American session the Canadian Dollar came under pressure as a result of a report detailing an unexpected trade deficit in April.

Canada’s merchandise trade balance came in as a deficit of 638 million Canadian Dollars in April, down from a surplus of 766 million Canadian Dollars in March.

The result was due to a 1.8 per cent drop in exports and a 1.4 per cent increase in exports.

While the Canadian Dollar struggled against the Pound as investors digested the Canadian news, the CAD/USD pairing’s losses were limited as the US Dollar came under pressure of its own.

The ‘Greenback’ lost some of its appeal after the nation’s ADP employment change report showed that it added less positions than expected in May, increasing the odds of Friday’s US non-farm payrolls report disappointing expectations.

US composite PMI was also shown to have softened from 58.6 to 58.4 in May, while the nation’s services gauge came in at 58.1 (down from 58.4 the previous month).

Tomorrow it would take a surprising decision from the Bank of England to inspire much in the way of GBP to CAD Exchange rate movement. As it stands economists are anticipating that no policy changes will be made.

However, during North American trading on Thursday Canada’s building permits report and Ivey Purchasing Managers PMI will have an impact on the Pound to Canadian Dollar exchange rate.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5456,

,Pound Sterling,0.5456,

Canadian Dollar, ,US Dollar,0.9156,

,US Dollar,0.9156,

Canadian Dollar, ,Euro,0.6715,

,Euro,0.6715,

Canadian Dollar, ,Australian Dollar,0.9859,

,Australian Dollar,0.9859,

Canadian Dollar, ,New Zealand Dollar,1.0877,

,New Zealand Dollar,1.0877,

US Dollar, ,Canadian Dollar ,1.0948,

,Canadian Dollar ,1.0948,

Pound Sterling, ,Canadian Dollar,1.8294,

,Canadian Dollar,1.8294,

Euro, ,Canadian Dollar,1.4895,

,Canadian Dollar,1.4895,

Australian Dollar, ,Canadian Dollar,1.0147,

,Canadian Dollar,1.0147,

New Zealand Dollar, ,Canadian Dollar,0.9194,

,Canadian Dollar,0.9194,

[/table]

Comments are closed.