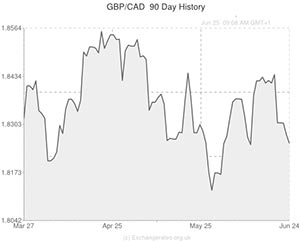

The GBP to CAD exchange rate was weaker on Wednesday as the Canadian currency continued to find support from positive data releases from last week and as the Pound continued to be softened by yesterday’s comments made by Bank of England Governor Mark Carney.

The Canadian Dollar advanced to its best level in over five months against its US relation as it continued to receive support from last week’s data which showed that the annual rate of inflation in Canada increased by 2.3% last month.

The rise marked the first time in over two years that the annual inflation rate had exceeded the Bank of Canada’s inflation target of 2%.

The data increased optimism over the health of the Canadian economy.

Today’s US data meanwhile sent the US Dollar sliding against most of its major peers. According to the Washington based Commerce Department, GDP in the world’s largest economy contracted at annual rate of 2.9% in the first quarter of 2014.

The figure was well below forecasts for a decline of 1.7%. The figure was the worst reading since 2009 and the scale of the revision downward was the biggest since records began back in 1976.

The Pound meanwhile continued to be under pressure from yesterday’s comments made by BoE Governor Mark Carney.

Investors were left disappointed after Carney indicated that interest rate rises will depend upon data and hinted that recent weak wage growth could lead the Central Bank to keep rates low for longer.

The currency was also softened by a report released by the Confederation of British Industry which showed that annual retail sales growth in the UK fell to a seven-month low this month as demand for food goods and clothes fell.

July’s figures are also expected to be subdued.

“The loss of momentum in retail sales in June indicated by the CBI does raise question marks as to how strong consumer spending can be until earnings growth picks up appreciably,” Howard Archer, chief UK economist at IHS Global Insight said.

The ‘Loonie’ could soften if risk aversion increases as a result of the deteriorating situations in Iraq and Ukraine.

Updated 09:30 GMT 26 June, 2014

GBP to CAD Exchange Rate Movement to Follow Average Earnings Data

The dovish interest rate commentary issued by the Bank of England earlier this week continues to weigh heavily on the GBP to CAD exchange rate.

During yesterday’s North American session the Pound to Canadian Dollar (GBP/CAD) exchange rate held recent declines while the CAD/USD pairing surged to multi-month highs in response to the disappointing growth figures out of the US.

Today sees the release of Canadian Average Weekly Earnings figures. As stagnant wage growth is one of the major factors weighing on fiscal policy in the UK, it will be interesting to see how its Canadian counterpart is faring in this area. Wage growth was up 3.1% year-on-year in March, so investors will be hoping for another reasonable result.

The GBP to CAD exchange rate could also be affected by the UK’s Financial Stability report. Similarly, CAD/USD volatility could be occasioned by US personal spending figures.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5488 ,

,Pound Sterling,0.5488 ,

Canadian Dollar, ,US Dollar,0.9326 ,

,US Dollar,0.9326 ,

Canadian Dollar, ,Euro,0.6840 ,

,Euro,0.6840 ,

Canadian Dollar, ,Australian Dollar,0.9937,

,Australian Dollar,0.9937,

Canadian Dollar, ,New Zealand Dollar,1.0704 ,

,New Zealand Dollar,1.0704 ,

US Dollar, ,Canadian Dollar,1.0721 ,

,Canadian Dollar,1.0721 ,

Pound Sterling, ,Canadian Dollar,1.8225 ,

,Canadian Dollar,1.8225 ,

Euro, ,Canadian Dollar,1.4625 ,

,Canadian Dollar,1.4625 ,

Australian Dollar, ,Canadian Dollar,1.0062 ,

,Canadian Dollar,1.0062 ,

New Zealand Dollar, ,Canadian Dollar,0.9351 ,

,Canadian Dollar,0.9351 ,

[/table]

Comments are closed.