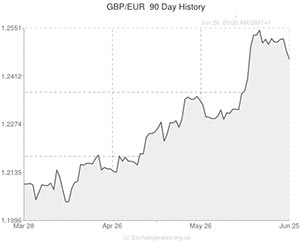

The Pound advanced back above the key 1.25 level against the Euro on Thursday after investor concerns over a possible overheating of the UK’s housing market were eased after the Bank of England announced new measures to try and cool down the market.

The Bank of England said that it will introduce the new measures in October and begin to cap mortgages.

It is hoped the measures will help to get consumer debts under control as well as take some of the heart out of the housing market; the sector of the economy which BoE Governor Mark Carney recently said was the biggest threat to the UK recovery.

The measures will see those people borrowing 85% of a house’s value will be unable to borrow more than four and a half times their income. The move is designed to prevent people falling into debt and reducing the amount of missed payments.

The Bank also introduces a new affordability test for the nation’s banks. The test will mean that potential borrowers will have to show that they can in fact repay their mortgage even if interest rates rise to 3%.

“Without policy action, the risk of excessive household indebtedness is material. The policy package is targeted to mitigate this risk in a prudent and proportionate fashion,” said the BoE.

According to the BoE’s figures UK citizens owed a massive £1.28 trillion on their homes in April. That is equivalent to around 76% of the UK’s entire GDP.

The US Dollar meanwhile was under pressure from yesterdays worse than expected GDP data and the Euro was edging closer to a one-and-a-half year low.

UPDATED 12:00 GMT 27 June 2014

GBP/EUR Exchange Rate Lingers just at 1.25 Level

The GBP to Euro exchange rate just about managed to continue trading above resistance at 1.25 as trading progressed on Friday.

While the Eurozone’s Business Climate Index disappointed hopes by falling to 0.2 from 0.37 rather than rising to 0.4, fluctuations in the Sterling/Euro exchange rate were limited as the UK’s final first quarter GDP figure was left unchanged. There had been hopes that the 0.8% quarter-on-quarter growth estimate might have been lifted to 0.9% because of upbeat UK construction figures, but this was not to be.

However, the pace of growth was still the most impressive for several years.

If today’s German Consumer Price Index shows that inflation climbed modestly in June, as economists have projected, the GBP to Euro exchange rate could ease lower before the close of European trading.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.7030 ,

,US Dollar,1.7030 ,

Pound Sterling, ,Euro,1.2508 ,

,Euro,1.2508 ,

Pound Sterling, ,Australian Dollar,1.8098 ,

,Australian Dollar,1.8098 ,

Pound Sterling, ,New Zealand Dollar,1.9389 ,

,New Zealand Dollar,1.9389 ,

US Dollar, ,Pound Sterling,0.5873 ,

,Pound Sterling,0.5873 ,

Euro, , Pound Sterling ,0.7995 ,

, Pound Sterling ,0.7995 ,

Australian Dollar, , Pound Sterling ,0.5526 ,

, Pound Sterling ,0.5526 ,

New Zealand Dollar, ,Pound Sterling,0.5166 ,

,Pound Sterling,0.5166 ,

[/table]

Comments are closed.