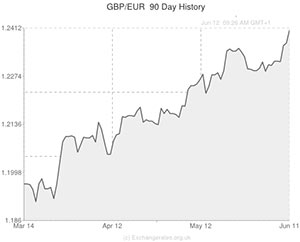

Wednesday’s stronger-than-expected UK employment gain helped the Pound consolidate gains against the Euro and rally to a fresh 18-month high.

Although UK wages were shown to have climbed by less-than-anticipated in the three months to April, employment did surge by 345,000 positions, taking the unemployment rate to 6.6 per cent – its lowest level since 2009.

In the aftermath of the report’s release the Pound gained on a largely static Euro and maintained a bullish relationship with its European peer for the entire local session.

Sterling was also trending higher against the US Dollar ahead of the publication of advance US retail sales figures.

The employment report did have some negative aspects, notably the softening in average wage growth, but the Pound was still able to extend its longest run of consecutive advances against the common currency since September.

Bloomberg News quotes economist Lee McDarby as stating; ‘I feel that against the Euro we will see 1.25 Euros sooner rather than later in light of renewed focus on UK interest-rate hikes. It will take an even bigger improvement in the outlook of the UK to allow the Pound to break much outside the $1.66 to $1.70 range.’

Over the next few weeks any indications of a reduction of slack in the UK economy could push the Bank of England into bringing forward their timeline for the increasing of interest rates and push the Pound even higher against its rivals.

During European trading the Euro fluctuated as separate reports showed an unexpected stagnation in the French consumer price index and a better-than-forecast increase in industrial production in the Eurozone.

The data revealed that the pace of industrial production in the Eurozone was twice as strong as expected in April, with output jumping by 0.8 per cent on a month-on-month basis rather than the 0.4 per cent increase anticipated. This was the best rate of monthly expansion for five months and was largely the result of an impressive increase in energy production.

The figure for March was negatively revised to a decline of 0.4 per cent but industrial production was up 1.4 per cent on the year.

In the hours ahead market movement could be triggered by advance retail sales figures for the US.

Investors with an interest in the GBP to Euro pairing will also be focusing on tomorrow’s UK construction output figures and Germany’s final inflation data for May. A strong construction gain for the UK could help the GBP to Euro exchange rate end the week on a high.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.6833,

,US Dollar,1.6833,

Pound Sterling, ,Euro,1.2442,

,Euro,1.2442,

Pound Sterling, ,Australian Dollar,1.7924,

,Australian Dollar,1.7924,

Pound Sterling, ,New Zealand Dollar,1.9429,

,New Zealand Dollar,1.9429,

US Dollar, ,Pound Sterling,0.5941,

,Pound Sterling,0.5941,

Euro, ,Pound Sterling,0.8039,

,Pound Sterling,0.8039,

Australian Dollar, ,Pound Sterling,0.5584,

,Pound Sterling,0.5584,

New Zealand Dollar, ,Pound Sterling,0.5147,

,Pound Sterling,0.5147,

[/table]

Comments are closed.