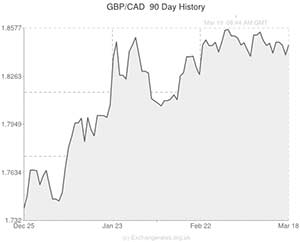

The Pound to Canadian Dollar exchange rate (GBP/CAD) jumped higher by around 1.8 cents yesterday evening in response to a dovish speech from Bank of Canada Governor Stephen Poloz.

The Central Banker said that domestic growth would be weak in the first quarter and predicted that inflation would remain soft in the first quarter. He also suggested that longer-term growth and inflation trends would remain lacklustre.

Poloz began his speech, which was ominously titled “Redefining the Limits of Growth”, by comparing the economic situation in Canada to a St. Patrick’s Day hangover:

“Happy belated St. Patrick’s Day. I hope everyone’s feeling fine. I want to speak today about a different kind of headache: the prolonged lacklustre economic growth we are experiencing”.

The BoC Governor then went on to predict that the inclement weather would probably have a negative impact on first quarter GDP and flagged that this February’s Consumer Price Index would most likely come in weakly because of the strong base level of comparison from February 2013.

Poloz also mentioned that the output gap is not likely to be erased for “a couple of years”, and hinted that further rate cuts would be possible if GDP and CPI continue to underwhelm. The dovish comments sent the ‘Loonie’ tanking as investors priced in the enhanced possibility of further Central Bank easing.

Earlier on in the day the Canadian Dollar had actually rallied by around half a cent in reaction to a positive domestic Manufacturing Sales report. The latest factory output figure showed that sales volumes increased by 1.5% during January, which is more than twice as fast as the 0.6% predicted by economists beforehand.

The US Dollar to Canadian Dollar exchange rate (USD/CAD) is currently close to a 4.5-year high, meaning that the Canadian Dollar’s relative weakness is likely to bolster Manufacturing Sales over the next few months as Canadian exports become more affordable to US buyers.

Data released later today is expected to show that the British Unemployment Rate held steady at 7.2% during January, but any figure south of the consensus could easily give the Pound a boost.

It is also possible that demand for Sterling could increase if the Bank of England’s latest Minutes report features positive sentiment from policymakers with regards to the UK’s impressive growth prospects this year.

Later in the day it is predicted that the Federal Reserve will taper its asset purchasing programme by a further -$10 billion, bringing QE3 down to $55 billion per month. This would likely be considered a risk-off decision and would most likely hamper demand for the risk-sensitive Canadian Dollar.

Comments are closed.