The Pound suffered steep losses against all of its major currency peers yesterday in response to news that the British consumer price index cooled from 1.9% to 1.6% in July.

The soft inflation figure, which undershot expectations of 1.8%, was seen to reduce the probability of an early rate hike from the Bank of England and this weakened demand for Sterling.

The Pound to US Dollar exchange rate declined by around a cent to a 4-month low of 1.620.

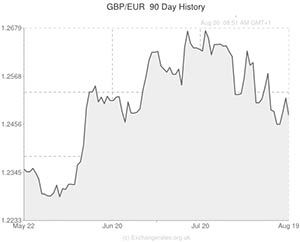

The Pound to Euro exchange rate fell by around half a cent to 1.2475.

The Sterling to Canadian Dollar exchange rate tumbled by around -0.7 cents to a 2.5-month low of 1.8140.

The Sterling to Australian Dollar exchange rate plunged lower by around -1.2 cents to a 4-month low of 1.7820.

And the Pound to New Zealand Dollar exchange rate plummeted by around a cent to 1.79730.

Sterling has struggled over the past seven days due to BoE Governor Mark Carney’s suggestion that interest rates won’t rise until wage growth improves markedly from its abysmal current level of -0.2%.

The Pound recovered slightly on Monday as traders reacted to another statement from Carney in which the Governor said that rates could actually rise before average earnings overtake CPI inflation. Carney’s comments wrong-footed markets because he was seen to be backtracking on what he had said just a few days earlier.

Some analysts interpreted the statement as a warning for traders that this morning’s BoE minutes report could strike a fairly hawkish tone.

Others speculated that Carney was growing uncomfortable amid accusations that he and Chancellor George Osborne had secretly arranged for borrowing costs to remain at record lows until after May’s general election. The hint that rates could rise sooner than that could therefore be seen as an attempt to assert the bank’s independence, an attempt to prove that the bank is reacting to economic indicators rather than political pressure.

Others argued that the Governor’s peculiar fluctuations in policy outlook were a sign that he doesn’t really have any idea when interest rates are going to rise.

Regardless of the motivation behind Carney’s latest comments it is crucial that this morning’s minutes report is seen to have a hawkish edge otherwise Sterling could remain at depressed levels versus the majors.

Due to recent falls in the headline unemployment rate, as well as sturdy private sector and GDP growth results, speculation is rife that at least one of the nine-person Monetary Policy Committee voted for a rate hike at the beginning of the month. If the minutes confirm this rumour then it could bolster demand for the Pound.

On the other hand if the report shows that the MPC was unanimous in its decision to hold rates at 0.50% in August then Sterling is liable to remain close to monthly lows versus its most-traded currency peers.

GBP Strengthens against USD, EUR, CAD & AUD after divided BoE Policymakers

The Pound firmed up against most of its major peers yesterday after the disastrous week preceding.

Yesterday the Bank of England published the minutes from its most recent monetary policy meeting. The minutes revealed a divided committee as two of the nine members voted against maintaining the current interest rate. The dissenting pair argued for an immediate rate hike by 25 basis points.

Since July 2011 the committee have been unanimous on their decisions regarding interest rate, but this break from the norm has fuelled speculation of an earlier-than-anticipated rate hike. The Pound strengthened across the board as a result.

Today’s Retail Sales data will be of interest to those backing the Pound. Traders will hope for a better-than-forecast result so Sterling can continue to make gains after experiencing such heavy losses last week.

Comments are closed.