The Sterling exchange rate (GBP) stuttered yesterday morning as Bank of England Governor Mark Carney announced another U-turn on monetary policy.

On June 12, 2014 Carney shocked markets in his Mansion House speech by indicating that interest rates could be raised before the end of the year. Prior to his hawkish comments markets had anticipated that the first rate hike would take place in February of next year. Following the Governor’s upbeat appraisal of the UK economy traders began to price-in a tightening of monetary policy in November of this year.

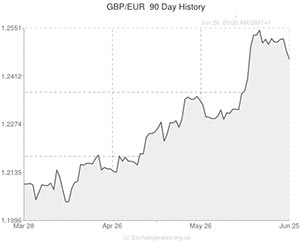

This sent the Pound to Euro exchange rate (GBP/EUR) to a fresh 1.5-year high above 1.25 and drove the Sterling to US Dollar exchange rate (GBP/USD) to a fresh 5.5-year high above longstanding psychological resistance at 1.70.

However, both GBP to Euro and GBP to USD plunged below psychological support yesterday morning in reaction to Carney’s latest switch in sentiment.

Speaking to the Treasury Select Committee, Carney warned that there was more slack in the British economy than first thought and cautioned that weak wage growth could scupper the bank’s plans to start raising interest rates.

The seemingly dovish statement sent markets into sell Sterling mode, and prompted one member of the Treasury to liken the Governor to an “unreliable boyfriend”. Pat McFadden’s accusation that Carney is sending out mixed signals to markets grabbed the headlines but reading between the lines of the Governor’s latest two policy speeches the message is clear:

The BoE is cheered by the rapid improvement in job creation, private sector activity and overall economic growth, almost to the extent that it is ready to start raising interest rates. However, the persistent level of slack in the domestic economy paired with Britain’s soft rate of wage growth means that the bank is prepared to wait a little longer before beginning its hiking cycle.

Another important message that Carney got across yesterday morning is that:

Interest rates are likely to start rising in the near future, but the process will be slow and deliberate: rates will almost definitely not hit the pre-crisis average of 5.0% in the next three years.

So, what does this mean for the Pound? Basically, future interest rate speculation will depend on future economic data releases. This means that each labour market, inflation, PMI or GDP release is likely to create enhanced volatility in Sterling pairs.

The Pound to Euro exchange rate (GBP/EUR) has lost its right to rest above psychological support at 1.25 and the Sterling to US Dollar exchange rate (GBP/USD) has been stripped of its right to remain above significant support at 1.70. These levels could be reached again over the next few weeks if British data prints positively, however, it is possible that demand for Sterling could drop-off if new economic indicators fail to suggest that the level of slack in the domestic economy is starting to wane.

Updated 11.35 GMT 26th June 2014

The Pound Exchange Rate climbed back above key levels against the Euro and US Dollar on Thursday after the Bank of England announced new measures to cool down the UK’s overheating housing market.

It announced the introduction of a repayment test to ensure that borrowers will be able to pay back mortgage loans and said that banks must limit the amount of money they lend. The measures are aimed at reducing consumer debt, a major threat to the UK’s economic recovery.

The Pound found support as the measures were seen as having little impact upon the economy in the short term. Bank of England Governor Marck Carney also said that the UK recovery is continuing to strengthen and broaden.

Comments are closed.