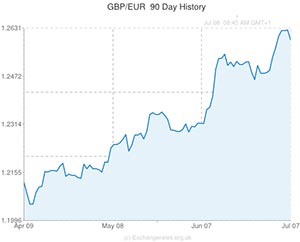

The Pound to Euro exchange rate (GBP/EUR) reached a fresh 21-month high of 1.2634 in the early hours of yesterday’s session as investors piled into the Sterling currency in anticipation of a rate hike from the Bank of England before the year is out.

A fortnight ago BoE Governor Mark Carney created a storm of controversy by releasing three contrasting policy statements in a short space of time. Ultimately, the Governor’s fluctuating outlook (which led to him being likened to an ‘unreliable boyfriend’ by one member of the Treasury Select Committee) ended with a bullish bias. Carney asserted that the overheating housing market is the biggest threat to financial stability in Britain. Markets read between the lines – as is necessary when dealing with unreliable boyfriends – and interpreted the statement as a warning that interest rates will likely be raised very soon. In response rate hike bets proliferated, UK Gilt Yields surged and the Sterling exchange rate strengthened.

A few days later Carney all but confirmed that a rate hike was on the cards by commenting that he was ‘comfortable’ with the current (enhanced) level of rate hike speculation.

In stark contrast to the BoE’s hawkish outlook the European Central Bank appears to be flirting with the idea of loosening monetary policy even further.

Just over a month ago the ECB announced a raft of new stimulus measures aimed at spurring lending in the real economy and driving the consumer price index higher. However, during the bank’s latest press conference President Mario Draghi admitted that policymakers are unanimous in their commitment to providing the Eurozone economy with the appropriate stimulus to provoke a substantial increase in the rate of inflation.

This gulf in outlook between the BoE and the ECB is the fundamental reason that the Sterling to Euro exchange rate is currently trading in the region of a 21-month high.

Recent data has pointed towards further trouble for the European Central Bank and enhanced optimism for the Bank of England.

On Friday it was announced that UK car sales accelerated at their fastest rate since 2005 in the first half of the year and that British consumer spending, as measured by Visa, hit a 4-year high in the second quarter.

Conversely, yesterday morning it was reported that German industrial production contracted at a monthly rate of -1.8% in May, confounding expectations of a 0.0% score.

Later today it is forecast that British industrial production will print at a monthly rate of 0.4%, bringing the annual figure up to a fresh 3-year high of 3.2%. Similarly, manufacturing production is estimated to have grown by 0.4% on a monthly basis during May, which will be enough to bump the annualised figure to a fresh 3-year high of 5.6%.

If the production reports match economists’ upbeat estimates then it is entirely likely that Sterling could stretch its recent gains further against the Euro as traders find the faith within themselves to trust the ‘unreliable’ Carney’s latest flirtation with rate hike rhetoric.

UPDATED 10:45 GMT 08 July, 2014

GBP to Euro Exchange Rate Declines after UK Reports

As the European session progressed on Tuesday the GBP to Euro exchange rate shed 0.15% as investors reacted to a disappointing set of Manufacturing and Industrial Production figures for the UK.

The reports justify the Bank of England’s decision to leave interest rates on hold for the foreseeable future and the Pound posted broad-based declines after they were published.

As well as declining notably against the Euro and US Dollar, the Pound fell by over 0.5% against the Australian Dollar and over 0.7% against the New Zealand Dollar.

Of course, with the National Institute for Economic and Social Research (NIESR) still to publish its growth report for the UK, further GBP to Euro exchange rate movement can be expected.

UPDATED: 22:50 GMT 08 July 2014

GBP to Euro Higher, GBP/USD Stronger Despite Jobs Data

At the close of the European session the GBP to Euro exchange rate clawed back previous losses as the National Institute of Economic and Social Research announced that the UK economy expanded by 0.9% in the three months to June.

The GBP/USD exchange rate also closed the local session in a stronger position as investors largely dismissed the upbeat US JOLTs Jobs Openings report ahead of the publication of minutes from the Federal Open Market Committee’s policy meeting.

Last week the US ADP Employment Change and Non-Farm Payrolls reports came in above expected levels and investors were hoping the JOLTs figure would create a hat trick of impressive results. They weren’t disappointed.

Jobs openings were shown to have jumped to an almost seven-year high in May in a sign that the US labour market is finally returning to pre-crisis levels.

According to analyst Terry Sheehan, jobs openings are ‘beginning to move in ways that inspires more confidence in the labour matket. It’s a pretty stable job market that’s improving incrementally. It’s good for the Fed.’

GBP to Euro exchange rate movement may be limited on Wednesday due to a lack of influential reports for the Eurozone and UK.

Comments are closed.