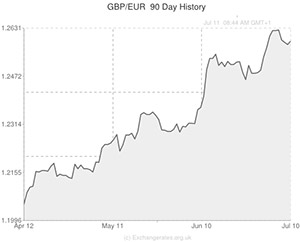

The Pound to Euro exchange rate (GBP/EUR) rallied back up towards psychological resistance at 1.26 yesterday as investors were reminded of the catastrophic debt crisis that wreaked havoc across the Eurozone between 2009 and 2013.

Shares in Banco Espirito Santo (BES), which is one of Portugal’s biggest banks, plummeted by over -17% as investors reacted to news that Espirito Santo International (ESI), a holding company related to BES, is planning to restructure some of its bond repayments. The news spooked traders out of BES shares and subsequently caused the bank to suspend trading.

The concerning situation at Banco Espirito Santo drove Portuguese 10-year borrowing costs up from 3.8% to just under 4.0% and pushed the main Portuguese stock index (PSI 20) lower by -4.5%.

Portugal was the third Eurozone nation to receive a bailout package from the Troika – the EU, the IMF and the EC – back in 2011. But after enacting a strict regime of reform and austerity the Iberian nation earned back the trust of financial markets and the three-year international bailout programme was concluded in May of this year.

However, the setback yesterday proves that the fissures caused by the debt crisis run deep throughout the Eurozone banking sector. The Euro depreciated by around a third of a cent against both the Pound and the US Dollar in reaction to the events at Banco Espirito Santo.

The single currency has remained relatively strong over the past two years because investors are aware that European Central Bank President Mario Draghi has pledged to do whatever it takes to keep the currency bloc afloat. So, rather than avoid the Eurozone because of its obvious flaws and many risks, traders have placed large amounts of funds in high-yielding investments, safe with the knowledge that the ECB will step in if things get out of hand.

This scenario has all the makings of an asset bubble and yesterday’s flare-up in Portugal should serve as a timely reminder that more needs to be done to shore-up the Eurozone banking sector and help spur employment and economic growth in the currency bloc.

One initiative that the ECB is yet to deploy is a full-scale bond-buying programme. Recent comments from Draghi suggest that policymakers are growing more and more comfortable with the prospect of quantitative easing in Europe. It now appears to be a question of ‘when’ rather than ‘if’.

Events such as that which occurred in Portugal yesterday could help persuade the European Central Bank to implement a QE scheme in the near future, something which would no doubt weigh on demand for the single currency.

For this reason it is entirely possible that the Pound to Euro exchange rate (GBP/EUR) could push towards 1.28 by the end of the year. This scenario is even more likely if the Bank of England decides to go in the opposite direction and raises interest rates in 2014.

Comments are closed.