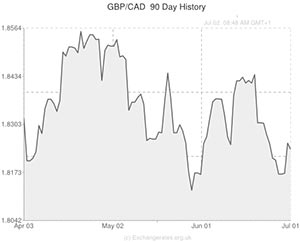

The Pound to Canadian Dollar (GBP/CAD) exchange rate initially came away from a high of 1.8283 during the North American session as the Canadian Dollar was supported by an improved Royal Bank of Canada (RBC) Manufacturing PMI.

Earlier in the day the Pound surged against its rivals as investors reacted positively to strong UK housing and construction figures.

Soon after the European session began the UK published Nationwide house price figures. The statistics were expected to show a 0.5% monthly increase in house prices and an 11.2% annual gain.

Actually, the data outlined a 1.0% month-on-month jump and a year-on-year advance of 11.8%.

Sterling pushed its way to fresh highs after the UK Construction PMI report detailed a 2.6 point gain, taking the index to 62.6 in June. A 0.2 point drop had been anticipated.

This report follows yesterday’s impressive UK manufacturing output figures. The Markit manufacturing measure climbed from 57 in May to 57.5 in June rather than falling as forecast.

However, while the Pound was riding high against its peers for much of the day, Pound to Canadian Dollar (GBP/CAD) exchange rate went on to trim its advance to 0.25% following the publication of Canada’s own manufacturing figures.

The RBC data showed that the index pushed up from a nine-month low of 52.2 recorded in May to 53.5 in June, taking it further into growth territory.

In the view of one Supply Chain Management Association (SCMA) official; ‘The second quarter of 2014 ended on a positive note for the Canadian manufacturing sector. Stronger business conditions were underlined by the fastest expansion of output so far this year, alongside a solid rebound in client spending. Manufacturers are continuing to recruit additional staff at a solid pace, highlighting strong confidence about the outlook for production volumes in the month ahead.’

However, any Canadian Dollar gains were limited by the fact that the price of Brent crude oil (a major Canadian export) dropped to a three-week low.

The Sterling to ‘Loonie’ exchange rate could fluctuate overnight as China’s non-manufacturing and services PMIs are published.

As the Canadian Dollar is a commodity-driven currency, a positive result from China could bolster the asset.

As the week progresses, any additional movement in the GBP/CAD pairing could be caused by the UK’s Composite and Services PMI figures, Canada’s International Merchandise Trade figures and the US Non-Farm Payrolls report.

Earlier today the US ADP Employment Change report showed that the nation added more positions than expected in June. As this measure is a good precursor to Non-Farm Payrolls, it could be indicative of an upbeat result.

The Pound to Canadian Dollar exchange rate has moved from highs of 1.8296 to lows of 1.8223 and looks set to be up 0.3% on the day.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5476,

,Pound Sterling,0.5476,

Canadian Dollar, ,US Dollar,0.9391,

,US Dollar,0.9391,

Canadian Dollar, ,Euro,0.6881,

,Euro,0.6881,

Canadian Dollar, ,Australian Dollar,0.9955,

,Australian Dollar,0.9955,

Canadian Dollar, ,New Zealand Dollar,1.0726,

,New Zealand Dollar,1.0726,

US Dollar, ,Canadian Dollar ,1.0632,

,Canadian Dollar ,1.0632,

Pound Sterling, ,Canadian Dollar,1.8262,

,Canadian Dollar,1.8262,

Euro, ,Canadian Dollar,1.4533,

,Canadian Dollar,1.4533,

Australian Dollar, ,Canadian Dollar,1.0049,

,Canadian Dollar,1.0049,

New Zealand Dollar, ,Canadian Dollar,0.9325,

,Canadian Dollar,0.9325,

[/table]

Comments are closed.