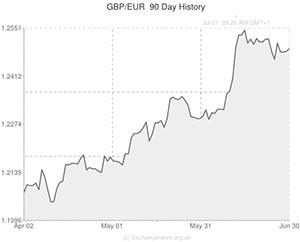

The Pound to Euro exchange rate (GBP/EUR) grappled with significant psychological resistance at 1.25 last week as Bank of England rate hike bets fluctuated in time to the sporadic beat of Governor Mark Carney’s comments on monetary policy.

Demand for Sterling softened noticeably on Tuesday when Carney struck a dovish tone, focussing on the lack of real wage growth and large degree of slack in the UK economy. GBP/EUR sunk from 1.2520 to 1.2460 in the aftermath of the speech.

However, the Pound received the pick-up it needed to re-surpass 1.25 on Thursday when the Governor stated that the overheating domestic housing market is the biggest threat to financial stability. Carney unrolled a new scheme to help cool the rapid acceleration of house prices, but markets saw the soft measures as a stepping stone towards a fully-fledged tightening of monetary policy (in the form of a rate hike). This sent GBP/EUR back up to 1.2520.

On Friday the Governor said that interest rates would probably hit 2.5% by 2017 and over the weekend outgoing Monetary Policy Committee (MPC) member Charlie Bean said that it was reasonable to suggest that the BoE will start its rate hike cycle by the beginning of next year and agreed with Carney that the benchmark rate may not reach the pre-crisis peak of 5.0% for a ‘very long’ time. These milder remarks from Carney and Bean had a less protracted impact on GBP/EUR trading because they were not seen to throw anything new into the equation of rate hike speculation.

The Pound to Euro exchange rate (GBP/EUR) weakened slightly (falling below 1.25) on Friday afternoon in response to data from the Eurozone showing that inflation in Germany rose from 0.9% to 1.0% in June. The slender rise in CPI suggests that this morning’s Eurozone inflation report will see the consumer price index rise from 0.5% to 0.6%.

The most important item on the economic calendar this week for the GBP/EUR currency pair is hotting up to be Thursday’s monetary policy decision from the European Central Bank. Because the ECB unleashed a raft of new measures in June (a rate cut, a deposit rate cut, an end of SMP sterilisation and a new liquidity scheme) which have not had time to take effect yet, it is very unlikely that the bank will opt to roll out any fresh stimulus this time out.

The fact that inflation within the currency bloc is rising (slightly) rather than falling also suggests that July’s ECB policy statement will not feature any new monetary easing measures.

If ECB President Mario Draghi chooses to employ a cautious tone, warning that inflation is still too low then it could damage demand for the single currency. Sterling is also likely to flourish if Draghi gives any more indication that the Governing Council is planning to implement a QE-style bond-buying programme.

However, due to the recent improvement in German CPI, it is more likely that the ECB Chief will opt for a more optimistic tone and will hold his quantitative easing cards close to his chest. This could actually boost demand for the single currency and could ensure that GBP/EUR remains below significant psychological resistance at 1.25.

UPDATED: 15:35 GMT 01 July, 2014

The Pound pushed higher beyond the 1.25 level against the Euro on Tuesday after it found support from a better than forecast manufacturing PMI report. The Euro meanwhile was weakened by a string of disappointing data releases.

Unemployment in the Eurozone remained close to record high levels and remained unchanged at 11.6% in May, beating expectations for a slight rise to 11.7%. In Germany unemployment increased unexpectedly as 9,000 people lost their jobs.

A separate report also showed that the Eurozone’s manufacturing recovery has stalled. According to Markit’s manufacturing PMI activity fell to a seven-month low of 51.8 in June, a fall from the 52.2 seen in May. Germany’s PMI dropped to an eight month low whilst France’s dropped to a six-month low of 48.2.

If tomorrow’s Eurozone GDP and PPI data disappoint then we can expect pressure to build on the European Central Bank to introduce new monetary easing measures in order to try and stimulate the region’s economy.

Comments are closed.