The Euro (EUR) managed to ease away from a two-year low against the Pound (GBP) on Thursday after the single currency found some support from expected inflation figures and as weak UK wage growth data released on Wednesday weighed upon Sterling.

According to data released by Eurostat, consumer prices across the Eurozone increased by 0.5% on an annual basis in June unchanged from the previous months figure and matched economist expectations.

The Euro benefitted as core inflation, which measures the more volatile parts of the economy, rose from May’s figure of 0.7% to 0.8% in the year up to June.

The improved figure eased some concerns that the region could slide into deflation and eases some of the pressure growing upon the European Central Bank to introduce new monetary easing measures.

‘The ECB will sit tight for now at least. Nonetheless continued low inflation means that expectations will persist that the ECB will ultimately have to take further action,’ said chief European economist at IHS Global Insight Howard Archer.

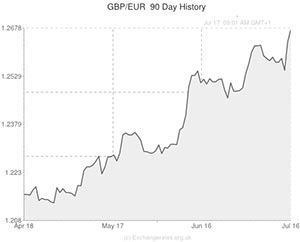

The Pound to Euro exchange rate is trending down at 1.2646.

June marked the ninth straight month in which the inflation rate was below 1%. The ECB targets an inflation rate of just below 2%.

Only Austria had an inflation rate close to the ECB’s target, with prices rising 1.7% from June 2013.

The inflation figures were enough to counter the softness expected to be caused by a separate report which showed that construction activity across the Eurozone fell in May.

Eurostat said that annual output fell from the previous figure of 8.0% to 3.5% in May, another indication that the region’s economy has stalled.

Also weighing upon the Pound was reduced market sentiment as new US sanctions against Russia raised concerns that the global economy could be negatively impacted.

The new punishing measures announced by the USA will target major Russian companies, causing some economists to warn that Russia could slide into recession as a result.

Sterling was finding some mild support however, after data published on Wednesday showed that the U.K. unemployment rate fell to its lowest level since late 2008. A separate weak wage growth report in the same period however slightly tempered expectations for the Bank of England to raise interest rates before the end of the year.

UPDATED 10:35 GMT July, 2014

Eurozone Current Account helps Pound Strengthen

After coming away from the almost two-year highs recorded earlier in the week, the Pound to Euro (GBP/EUR) exchange rate managed to strengthen ever-so-slightly on Friday.

UK data was lacking but a report from the Eurozone showed that the currency bloc’s current account surplus declined in May.

The GBP to EUR pairing is currently trading in the region of 1.2642, close to the day’s high of 1.2649.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3531 ,

,US Dollar,1.3531 ,

Euro, , Pound Sterling,0.7907 ,

, Pound Sterling,0.7907 ,

Euro, ,Australian Dollar,1.4432 ,

,Australian Dollar,1.4432 ,

Euro, ,Canadian Dollar,1.4540 ,

,Canadian Dollar,1.4540 ,

Pound Sterling, ,Euro,1.2646 ,

,Euro,1.2646 ,

US Dollar, ,Euro,0.7390 ,

,Euro,0.7390 ,

[/table]

Comments are closed.