The Pound made further gains against the already weakened Euro on Monday after data releases out of the single currency bloc showed that the region is once again weakening as manufacturing and service sector activity fell in June.

According to Markit Economics, a PMI for both manufacturing and services declined to 52.8 in June from the 53.5 figure recorded in the previous month. The data may have fallen but it still marked a 12th consecutive month where the gauge has been above the 50 mark which divides expansion from contraction.

Individually the Euro area’s manufacturing purchasing managers’ index fell to 51.9, down from a final reading of 52.2 in May. Economists had been expecting an unchanged reading.

The bloc’s services PMI declined to 52.8 from 53.2 in May, compared to expectations for an uptick to 53.3.

The Euro was also continuing to be weighed upon by the European Central Bank’s decision to cut interest rates and introduce a negative deposit rate for the regions banks.

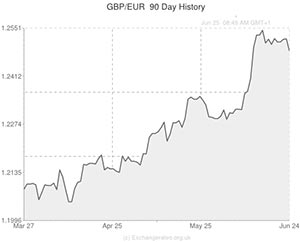

The Pound to Euro exchange rate is currently trading around 1.24781 – 24/06/14 at 14.20 GMT

Some economists are hoping that as those measures take effect the Eurozone economy should improve.

“Hopefully the recent stimulus measures from the ECB will help revive growth again, something which may already be evident as the survey saw the largest inflows of new business for three years in June. A concern is that a second consecutive monthly fall in the index signals that the Eurozone recovery is losing momentum,” said Markit chief economist Chris Williamson.

Germany showed signs of improvement however as the nation’s manufacturing PMI ticked higher to a two-month high of 52.4 in June, up from the 52.3 recorded in May. Its composite PMI meanwhile was lower than the previous months figure.

France on the other hand continues to disappoint as manufacturing and services both showed a decline.

“There remains little sign of any turnaround in the performance of France’s economy at the end of the second quarter. On these trends the economic underperformance of France seems to persist well into the second half of the year,” said Paul Smith, a senior economist at Markit.

The next batch of Eurozone data is due on Friday when the latest confidence data is released.

UPDATED 24/06/14 at 14.20 GMT – Pound falls below key 1.25 level on Carney comments

The Pound weakened further against the Euro to drop below the key 1.25 level after Bank of England Governor Mark Carney told a government Treasury Committee that a rate hike will depend upon wage growth data, Data which came in well below expectations earlier in the year.

The comments dampened sentiment towards the Pound. Against the US Dollar Sterling dropped below the key 1.70 range.

“The Bank of England’s testimony to the Treasury Select Committee left money markets reeling from yet another whipsaw in policy outlook. After suggesting that rate hikes may happen sooner than expected in his Mansion House speech, Carney shocked the market with a far more dovish performance,” said the head of Monex Europe.

The Euro could make further gains tomorrow if the latest GFK Consumer Confidence data for Germany and data for other Eurozone members comes in positively.

The US Dollar could make further gains today if the upcoming US CB Consumer confidence and new home sales reports show a further strengthening of the US economy.

UPDATED 24/06/14 at 09:20 GMT

The Pound fell further below the psychologically key level of 1.25 against the Euro today as the single currency found support from data which showed that consumer sentiment in Germany rose more than forecast due to the interest cut announced by the European Central Bank (ECB) earlier this month.

“The cut in rates by the ECB and the decision to charge banks for parking their money at the bank has given the consumer climate an extra boost and is the main reason behind the rise in consumer confidence,” said market research company GfK.

Further gains were restrained however as concerns over the situation in Ukraine and data which showed a fall in French business confidence and painted a rather stagnant picture of the wider region’s economy. Industrial production in Austria slowed and quarter on quarter GDP data for the Netherlands showed a contraction. Year on year showed stagnation of 0%.

With a lack of further market moving data due the GBP/EUR Exchange Rate is likely to see little movement unless geopolitical tensions in Ukraine and Iraq weaken and today’s US data comes in strongly.

UPDATED 15:30 26 June, 2014

Pound to Euro (GBP/EUR) Exchange Rate Trending Higher after BoE Report

On Thursday the Pound to Euro (GBP/EUR) exchange rate climbed as investors responded to the Bank of England’s Financial Stability report.

The report outlined new measures for tackling the UK’s overheating housing market.

Economist Martin Beck had this response to the outlined proposals; ‘Mark Carney emphasised that the FPC’s actions were more about heading off future risks arising from riskier lending and avoiding the need for more drastic action later. In this respect, as an insurance policy, today’s announcements seem sensible. The fact that the FPC has been willing to bare its teeth, highlighting the possibility of further restrictions in the future, should have some effect in dampening the belief held by some that the only direction for house prices is up.’

Euro movement was limited during the European session due to a lack of influential economic news for the Eurozone, but the British development saw the Pound to Euro (GBP/EUR) exchange rate rise by 0.46% and push above technical resistance at 1.25.

If tomorrow’s final first quarter growth data for the UK surprises to the upside we could see the Pound to Euro (GBP/EUR) exchange rate test new highs.

Comments are closed.