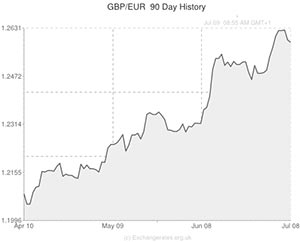

While the GBP/USD exchange rate was bsofter ahead of the publication of minutes from the latest Federal Open Market Committee meeting, the Pound to Euro (GBP/EUR) exchange rate shed 0.15% during the European session.

Sterling initially plummeted on Tuesday as a concerning dip in both Manufacturing and Industrial Production levels had a brief dampening effect on Bank of England rate hike speculation.

However, after investors bet that the May figures were merely an anomaly the Pound was able to edge higher against its rivals.

On Wednesday some modest declines in the Pound to Euro (GBP/EUR) exchange rate occurred as other UK fundamentals disappointed expectations.

Firstly, the British Retail Consortium (BRC) announced a 1.8% annual decline in UK shop prices in June.

This was the steepest year-on-year drop since 2006 and is indicative of the current supermarket price war.

Non-food prices slumped by 3.4% while food prices advanced by just 0.6%.

According to the Director General of the BRC; ‘Fierce competition among grocers has driven food price inflation to record low levels and with some grocers having announced plans to keep prices down, consumers stand to benefit for a while to come.’

In May the BRC’s Shop Price Index fell by 1.4% on a year-on-year basis.

Then, as the European session got underway, Halifax published its House Price report.

Although economists had expected house prices to decline by -0.3% on a month-on-month basis – following an increase of 4.0% in May – values actually dropped by -0.6%.

One of the main reasons for the Bank of England adopting a more hawkish rate hike bias is the UK’s overheating housing market. If house prices appear to be cooling it could alleviate some of the pressure on the central bank and push back the timeline for hiking borrowing costs – an eventuality which would be Pound-negative.

However, the report also showed that UK house prices were up 2.3% in the second quarter of the year from the first, prompting this response from one Halifax official; ‘Housing demand continues to be supported by an economic recovery that is gathering pace.’

A lack of economic news from the Eurozone kept the Pound to Euro (GBP/EUR) exchange rate trending in a fairly narrow range for much of Wednesday, but volatility in the pairing is forecast to occur in response to tomorrow’s UK Trade Balance figures and Bank of England rate decision.

The European Central Bank’s Monthly Report will also be of interest.

If the FOMC minutes, due out at 19:00 GMT, reiterate Fed Chairwoman Janet Yellen’s dovish stance, the GBP/USD exchange rate could advance during the North American session.

UPDATED 22:20 GMT 09 July 2014

Pound to Euro (GBP/EUR) Exchange Rate Slips before BoE

The expectation that the Bank of England will leave fiscal policy unaltered when in gathers on Thursday saw the Pound to Euro exchange rate slide below 1.26 during the North American session.

The GBP/EUR pairing failed to benefit from comments issued by the BoE’s Deputy Governor-Designate.

Nemat Shafik remarked on the ‘striking’ nature of the UK’s economic recovery and insinuated that the level of slack in the UK economy may be less than the BoE realises.

According to economist Philip Rush; ‘If this is an actual shift in the numbers for slack, then rate hikes really will have to happen this year. The MPC said in May there was room to use up more slack before hiking. But all members have acknowledged the need to start hiking before all slack is gone.’

Although the Pound to Euro (GBP/EUR) exchange rate was trending in a softer position, the GBP/USD pairing climbed modestly following the publication of the Federal Open Market Committee meeting minutes.

UPDATED: 10:20 GMT 10 July, 2014

With the UK’s Trade Balance figures disappointing expectations and the European Central Bank’s monthly report containing no negative surprises, the Pound to Euro (GBP/EUR) exchange rate is still trending below technical resistance of 1.26.

The pairing declined by 0.15% during the European session and may hold these losses until tomorrow.

The Bank of England meeting is unlikely to have much influence on the direction taken by either the GBP/EUR or GBP/USD exchange rates, but investors will be looking ahead to tomorrow’s UK Construction Output report.

It is expected that the level of construction output in the UK climbed by a seasonally adjusted 0.9% in May, month-on-month, and was up 5.6% on the year.

Tomorrow’s final German inflation data could also have an impact on the Pound to Euro (GBP/EUR) exchange rate before the weekend.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.7111,

,US Dollar,1.7111,

Pound Sterling, ,Euro,1.2569,

,Euro,1.2569,

Pound Sterling, ,Australian Dollar,1.8193,

,Australian Dollar,1.8193,

Pound Sterling, ,New Zealand Dollar,1.9427,

,New Zealand Dollar,1.9427,

US Dollar, ,Pound Sterling,0.5845,

,Pound Sterling,0.5845,

Euro, ,Pound Sterling,0.7956,

,Pound Sterling,0.7956,

Australian Dollar, ,Pound Sterling,0.5499,

,Pound Sterling,0.5499,

New Zealand Dollar, ,Pound Sterling,0.5147,

,Pound Sterling,0.5147,

[/table]

Comments are closed.