The Pound slumped to its lowest level in a week against the Euro and declined against other major peers on Thursday after data showed that UK retail sales fell for the first time in four months last month.

According to the Office for National Statistics retails sales fell by 0.5% month on month to show overall growth of 3.9% year on year, a decline from Aprils close to ten year high figure of 6.5%. The -0.5% fall was widely expected by economists.

Sales excluding fuel dropped also dropped by 0.5%, slightly less than the 0.6% fall forecast. On a year by year basis sales excluding fuel climbed by 4.7% just short of the 4.8% rise expected by economists.

The ONS said that the decline in sales would have been higher if it had not been for a strong surge in the sale of replica football kits ahead of the World Cup.

The data also showed that food sales dropped by 2.4%, the sharpest fall recorded since January.

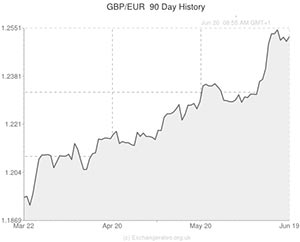

The Pound to Euro exchange rate is trading around 1.2474 while GBP to USD is trading at 1.7012.

The fall in retail sales volumes came despite a drop in prices in stores, which declined 0.7% their biggest drop since September 2009.

The Pound also remains under pressure from yesterday’s Bank of England policy meeting minutes which widely disappointed investors as they were less hawkish than anticipated. Despite that the outlook for the UK economy remains upbeat.

Against the US Dollar the Pound was trading at a five year high after the US currency was weakened by last night’s Federal Reserve policy meeting.

The Central Bank disappointed economists by saying that it expects interest rates to remain low for some time.

In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%. It also lowered its growth expectations for the rest of 2014.

Pound to Euro Update – 16:00 GMT on 20/06/2014

The Pound made gains against the Euro and remains above the 1.25 level after the single currency was weakened by the release of weaker than forecast German producer price inflation data.

The report showed that producer price inflation in the Eurozone’s largest economy declined by 0.2% last month, below expectations for a 0.2% rise. The decline adds to April’s fall of 0.1% and adds to concerns over the regions inflation rate. The single currency found some support after data showed that the region posted a current account surplus of €18.71 billion in April.

Earlier in the session the International Monetary Fund said that the European Central Bank would need to move to full-scale quantitative easing if inflation in the Eurozone remains in the doldrums.

“If inflation remains stubbornly low, the ECB should consider a large-scale asset purchase program; this would boost confidence, improve corporate and household balance sheets and stimulate bank lending,” said the IMF.

Comments are closed.