As this week’s manufacturing and services PMI reports for the UK both disappointed expectations, the Pound has been struggling against its major currency counterparts.

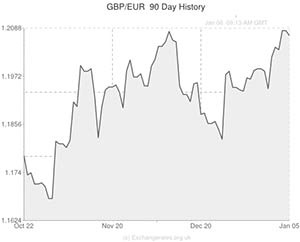

During European trading the British asset hit a three-week low against the Euro, although GBP/EUR declines were limited after the appeal of the Euro was knocked by a disappointing German factory orders report.

The Pound also extended declines against the US Dollar as domestic housing data showed that house prices rose in January – fuelling fears of a housing bubble.

Sterling’s bearish relationship with its peers persisted after the Bank of England acted as economists expected and held interest rates at record lows.

The level of asset purchases was also left unaltered.

Although the UK economy enjoyed its most rapid pace of annual expansion since 2007 last year, and despite the fact that the unemployment rate is dropping towards 7 per cent faster than anyone expected, the Monetary Policy Committee is keen to show that it’s in no rush to raise interest rates.

However, economist and former BoE official Rob Wood was quoted as saying; ‘The big picture is the tightening labour market and that means an interest rate hike has to come sooner than they previously said. The difficulty is, because they have made quite a large forecast error, it requires a bit of an about-face in terms of what they may have been planning’.

Sterling drifted lower after the BoE announcement but could experience additional volatility following the European Central Bank’s turn in the spotlight.

Indeed the GBP/EUR pairing went on to recover losses before the central bank announced its own rate decision. A dovish response from the central bank could push the Euro lower.

Tomorrow Pound movement could be inspired by UK trade balance figures and the domestic industrial/manufacturing production reports.

Of course, Friday’s influential US non-farm payrolls data may also have far reaching repercussions. Given that December’s jobs data disappointed, a positive result is needed to justify the Federal Reserve’s decision to persist with tapering stimulus.

Pound (GBP) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,US Dollar,1.6304 ,

,US Dollar,1.6304 ,

Pound Sterling, ,Euro,1.2066,

,Euro,1.2066,

Pound Sterling, ,Australian Dollar,1.8204,

,Australian Dollar,1.8204,

Pound Sterling, ,New Zealand Dollar,1.9807 ,

,New Zealand Dollar,1.9807 ,

US Dollar, ,Pound Sterling,0.6138,

,Pound Sterling,0.6138,

Euro, ,Pound Sterling,0.8288,

,Pound Sterling,0.8288,

Australian Dollar, ,Pound Sterling,0.5500,

,Pound Sterling,0.5500,

New Zealand Dollar, ,Pound Sterling,0.5042,

,Pound Sterling,0.5042,

[/table]

Comments are closed.