The Pound may have faltered slightly yesterday as the UK manufacturing PMI came in slightly shy of estimates, but the British currency recovered losses against the US Dollar and extended gains against the Euro in the wake of a stream of positive UK news.

Firstly, a Nationwide housing report detailed a 1.4 per cent month-on-month increase in UK house prices. This was double the 0.7 per cent estimate and further proof that a buoyant housing market continues to underpin the UK’s economic recovery.

House prices were up 8.4 per cent on the year in December.

Later separate figures revealed that UK mortgage approvals increased by the most for nearly six years, jumping 70,800 in November rather than the 69,700 expected.

The Pound derived additional support from the news that the UK construction sector enjoyed an eighth month of expansion in December, with the PMI coming in at 62.1 – down from November’s reading of 62.6 but better-than-forecast and considerably above the 50 mark separating growth from contraction.

In the Markit report construction output was given a positive outlook for the year ahead while commercial work was shown to have increased at the most rapid pace since August 2007.

David Noble of the Chartered Institute of Purchasing and Supply had this to say of the result; ‘Continued strong expansion marked an outstanding end to 2013 for UK construction, positioning the sector on a strong recovery path for 2014. […] The positive business outlook and soaring confidence reported in December suggests this upswing will be maintained well into the New Year.’

Similarly, Markit economist Tim Moore observed; ‘the improving UK economic outlook is helping boost private sector spending patterns, meaning that the construction recovery has started to broaden out from housing demand and infrastructure projects to include strong growth in commercial building work.’

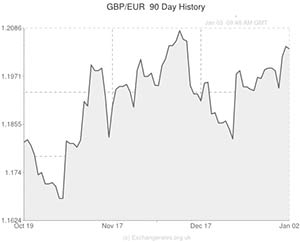

Although the Pound’s gains against the US Dollar were limited as the latter currency maintained a bullish stance as a result of yesterday’s impressive US manufacturing report, Sterling was able to strengthen against the Euro and post gains against several of its other most traded currency rivals.

Next week Pound movement could be triggered by several influential UK data releases, including the nation’s services PMI, trade balance figures and industrial/manufacturing production reports.

Of course, the Bank of England’s rate decision (due to be delivered on Thursday) is also likely to have a notable impact on the Pound.

It is expected that the BoE will maintain the current level of asset purchases and leave rates unaltered.

Current Pound Sterling (GBP) Exchange Rates:

< Down > Up

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6463 >

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.2059 >

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.8300 <

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.9891 <

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6076 <

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8289 <

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5460 >

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5020 >

(As of 11:00 GMT)

Comments are closed.