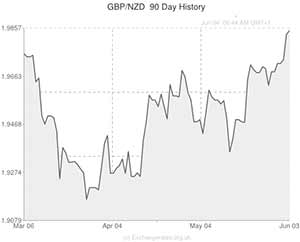

The Pound to New Zealand Dollar exchange rate (GBP/NZD) rallied by around a cent yesterday afternoon to reach its highest level since March 6th.

Investors opted to short-sell the ‘Kiwi’ Dollar in reaction to news that Fonterra’s global dairy trade price index (GMT) plummeted by -4.2% to $3,756 per ton at the latest dairy auction. The substantial decline in dairy prices marked the eighth auction in a row that prices have fallen.

Sterling rallied from 1.9785 to 1.9880 in reaction to the soft GMT auction result as traders digested the implications that lower dairy prices could have on the New Zealand economy. Dairy products are the Antipodean nation’s largest export, accounting for over 7% of total economic output. If dairy prices continue to plunge then it could have a sizeable impact on New Zealand GDP over the coming quarters and this could persuade the Reserve Bank of New Zealand to pause its interest rate hiking programme.

Earlier in the day it was announced that UK construction output decelerated from 60.8 to 60.0 in May as firms failed to meet demand due to problems in the supply chain. The mildly underperforming report had only a limited impact on demand for the Pound.

Later this morning Sterling could face slightly more volatility if May’s service sector PMI report shows any surprises. Analysts anticipate a score of 58.2 – slightly lower than April’s reading of 58.7. The services PMI is considered the most important UK private sector report because tertiary output accounts for around 75% of British GDP. If the figure comes in below 58.0 then it could spell trouble for Sterling but if the PMI prints around the 59.0 mark or higher then it could drive GBP/NZD to a fresh 3-month high.

GBP/EUR

Sterling failed to make any inroads against the Euro yesterday despite data showing that inflation in the currency bloc is currently running at a joint-4-year low of 0.5%. The weaker-than-anticipated consumer price index result puts more pressure on the European Central Bank to loosen monetary policy aggressively at its meeting on Thursday.

Markets have already priced in a high probability that the ECB will cut the benchmark interest rate to 0.10% or 0.15% and reduce the deposit rate to -0.10% or -0.15% but there is potential for the bank to unleash further stimulus measures as well. GBP/EUR’s failure to rally yesterday suggests that investors will not be minded to short-sell the single currency on Thursday unless the obligatory rate cuts are accompanied by further non-standard measures.

A QE-style bond-buying programme and a decision to stop the sterilisation of bonds purchased under the Securities Market Programme (SMP) are two of the possible options available to the ECB. It seems likely that the Pound to Euro exchange rate will struggle to reach fresh 1.5-year highs unless the ECB acts strongly on Thursday afternoon.

Comments are closed.