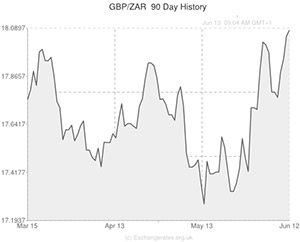

On Friday the news that a top ratings agency had downgraded South Africa’s credit rating outlook to negative dragged the Rand lower against the Pound.

The GBP/ZAR exchange rate was already trending higher as a consequence of comments issued by Bank of England Governor Mark Carney.

Although the UK’s Chancellor of the Exchequer, George Osborne, had earlier knocked the appeal of the Pound by intimating that the BoE now has the power to put a cap on mortgages proportional to the income of the borrower, Carney’s remarks helped the asset recoup losses.

The BoE has been stressing for months that the level of slack in the domestic economy needs to be reduced before the central bank will consider issuing an interest rate increase, and the central bank stuck to its guns even as UK economic indicators continually surprise to the upside.

However, during a speech in London Carney stated that interest could rise ‘sooner than markets currently expect.’

After he made his remarks the Pound jumped to a 19-month high against the Euro and rallied against several of its other most traded rivals.

The British asset was able to extend gains against the Rand after Fitch, one of the world’s leading foreign exchange providers, gave South Africa a negative credit rating outlook. The country previously held a stable outlook, but the ongoing mining sector strike has had a serious impact.

Growth forecasts for South Africa were also negatively revised by Fitch, with the nation’s GDP now expected to grow by 1.7 per cent this year instead of the 2.8 per cent expansion forecast earlier in 2014. In 2015 it is expected that the South African economy won’t grow by 3.5 per cent, as originally hoped, but 3 per cent.

Fitch stated; ‘Increased strike activity, high wage demands and electricity constraints represent negative supply side shocks. So far, the sharp depreciation of the Rand over the past two years has not fed through to clear signs of improvement in competitiveness and growth.’

If Fitch follows through with a downgrade to the nation’s credit rating further Rand losses could be on the cards.

Standard & Poor’s, another of the world’s major ratings agencies, is also expected to slash South Africa’s credit rating today.

Meanwhile, the Pound was posted by the news that the pace of construction output in the UK increased by more than expected in April, year-on-year.

Construction output climbed by 4.6 per cent on an annual basis rather than the 2.9 per cent anticipated. On a month-on-month basis construction output was up 1.2 per cent in April, slightly less than the increase of 1.5 per cent expected.

South African Rand (ZAR) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Pound Sterling, ,South African Rand,18.2203,

,South African Rand,18.2203,

Euro, ,South African Rand,14.5732,

,South African Rand,14.5732,

US Dollar, ,South African Rand,10.7395,

,South African Rand,10.7395,

Australian Dollar, ,South African Rand,10.0355,

,South African Rand,10.0355,

New Zealand Dollar, ,South African Rand,9.2571,

,South African Rand,9.2571,

Canadian Dollar, ,South African Rand,9.8424,

,South African Rand,9.8424,

[/table]

Comments are closed.