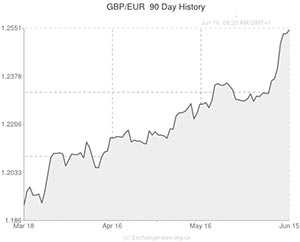

The Pound surged above the 1.25 level against the Euro over the weekend and continued to push higher on Monday after comments made by Bank of England Deputy Governor Charlie Bean increased expectations that the Central Bank will raise interest rates sooner than expected.

In an interview with the Sunday Times Mr Bean said an interest rate rise would be a symbolic step in showing that the UK economy has finally returned to normality.

The comments add to those made last week by BoE Governor Mark Carney who suggested that there could be an interest rate rise before the end of this year.

The Euro meanwhile was weakened further on Monday by the release of data which showed that there was a further slowdown in Eurozone inflation last month, confirming that the European Central Bank was right to take action to try and stem the threat from low inflation at its recent policy meeting.

According to the data released by Eurostat, consumer prices in the 18-member Eurozone increased by an annual rate of 0.5% in May, well below the ECB’s target rate of just under 2%. Prices fell by 0.1% last month as the cost of services dropped by 0.2% compared with April.

Today’s data also increased the likelihood that further measures will be needed to stave off the threat of region wide deflation.

Three of the Eurozone’s members are already experiencing deflation. Greece saw inflation tumble by a further 2.1% last month, Portugal is seeing a rate of -0.3% and Cyprus -0.1%.

A report released last week showed that inflation in Germany fell to a four-year low and that Spain and Italy also saw a slowdown.

While falling prices may sound good for consumers, deflation is actually dangerous for the economy because it can trigger a vicious spiral where businesses and households delay purchases, which in turn throttles demand and causes companies to lay off workers.

Against the perceived riskier assets such as the Australian Dollar, South African Rand and Canadian Dollar the Euro firmed as concerns over the situation in Iraq caused investors to seek shelter in safe haven assets.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,US Dollar,1.3529 ,

,US Dollar,1.3529 ,

Euro, , Pound Sterling,0.7974 ,

, Pound Sterling,0.7974 ,

Euro, ,Australian Dollar,1.4415 ,

,Australian Dollar,1.4415 ,

Euro, ,Canadian Dollar,1.4703 ,

,Canadian Dollar,1.4703 ,

Pound Sterling, ,Euro,1.2543 ,

,Euro,1.2543 ,

US Dollar, ,Euro,0.7392 ,

,Euro,0.7392 ,

[/table]

Comments are closed.