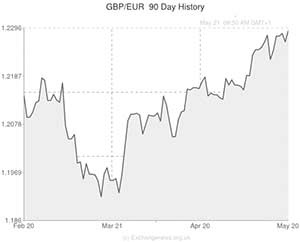

The Pound climbed to its best level in 16-months against the Euro on Tuesday after data showed that consumer price inflation in the UK rose more-than-expected in April.

According to the Office for National Statistics, the UK’s inflation rate rose by 1.8% on a year-on-year basis in April. The figure was higher than March’s figure of 1.6%.

The increase was the first rise in inflation recorded in ten-months.

On a month-on-month basis, inflation increased by 0.4%, higher than economist forecasts for a rise of 0.3%.

The Retail Price Index, the wider measure of inflation meanwhile remained steady at 2.5%.

The rise was said to be as a result of rise in transport costs due to late Easter holidays. Airfares increased by 18%, sea fares rose by 22% and petrol prices ticked higher. Food costs meanwhile dropped by 0.5% as a result of better growing conditions compared to the previous year.

The Pound saw further gains restrained and eased slightly on concerns that inflation could begin to outpace wage growth.

“Inflation remains below target as it stands at the moment, but April’s increase has seen inflation back to outstripping wages. Mark Carney said at the weekend that the Bank of England hopes that wages will accelerate soon, as productivity increases, and we will see a near-term lull in inflation. Labour market slack still exists and we will not see wages increase meaningfully until the labour market tightens further,” said Jeremy Cook, chief economist at World First.

The Euro meanwhile was softened earlier in the session after data out of Germany showed that producer prices in the region’s largest economy fell more-than-expected in April.

PPI fell to -0.9% on a year-on-year basis and by -0.1% on a month-on month basis.

The Pound could strengthen further on Wednesday if UK retail sales data comes in strongly as forecast and the Bank of England’s policy meeting minutes are also due for publication.

Pound to Euro Update – 21/05/14

The GBP to Euro Exchange Rate was little changed on Wednesday morning despite data showing that the Eurozone recorded a current account surplus of €20.90 billion in March.

The figure was a mild improvement on the previous month and was just above economist expectations for a figure of €20.9 billion.

Later in the session we can expect the Pound to make further gains against the Euro as today’s UK retail sales data is expected to come in strongly.

The Bank of England is also due to publish the minutes of its latest policy meeting. Investors will be keen to see how the Central Bank views the health of the economy.

Of particular interest will be what the MPC discussed regarding the UK housing market which Bank Governor Mark Carney labelled as the biggest threat to the economic recovery.

Also due later in the session is the latest Eurozone consumer confidence data. With events in Ukraine, weak GDP data and expectations for the ECB to introduce new easing measures at next month’s policy meeting we can expect the figure to come in below forecasts.

Comments are closed.