The Pound entered this week’s session in a buoyant mood versus its fellow currencies due to widespread optimism that the Bank of England could start hiking interest rates before the end of 2014.

BoE rate hike bets took a considerable leap higher towards the end of last week in response to comments from Governor Mark Carney suggesting that the rapidly advancing UK economy is ready for a little bit of monetary tightening:

“There’s already great speculation about the exact timing of the first rate hike and this discussion is becoming more balanced. It could happen sooner than markets current expect”.

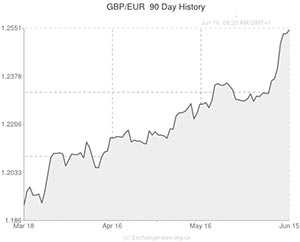

The Pound to Euro exchange rate (GBP/EUR) grew to a fresh year-and-a-half high of 1.2546 in response to the news, whilst the Sterling to US Dollar exchange rate (GBP/USD) came within 10 pips of striking a fresh 4.5-year high of 1.7000.

The Pound also racked up gains of 1.5 cents or higher versus the commodity-sensitive Canadian Dollar (CAD), Australian Dollar (AUD) and New Zealand Dollar (NZD).

GBP to Euro

Eurozone inflation is predicted to print at 0.5% later on this morning and it is possible that GBP to Euro will appreciate further in response to the soft consumer price index report as the central bank outlooks of the BoE and the ECB diverge further. The BoE is now looking likely to become only the second major central bank to start raising rates (behind the Reserve Bank of New Zealand). On the other hand, the European Central Bank may well unleash a QE-style bond-buying programme to stave off the threat of deflation, despite the fact that the bank only recently announced a fresh batch of monetary stimulus measures.

The outlook favours Sterling strength against the single currency and it is possible that Pound to Euro could continue to rally over the next few days towards 1.2600.

GBP to USD

The Sterling to US Dollar exchange rate (GBP/USD) resumed its uptrend at the end of last week’s session due to the massive upgrade in BoE rate forecasts. The Sterling overnight interbank average curve, which measures rate hike expectations, suggests that traders expect the bank to start raising rates in November of this year, rather than in February of next year – as was the case prior to Carney’s Mansion House speech.

The Governor stated that any decisions to modify the benchmark interest rate would be data-dependent and therefore it is possible that the Pound could appreciate further if British economic indicators continue to impress.

Standing just below key technical and psychological resistance at 1.7000 it is difficult to tell whether Sterling has the legs to reach a fresh 4.5-year high against the US Dollar. On the one hand the hawkish monetary policy outlook of the BoE bodes well but on the other hand it is worth mentioning that GBP/USD collapsed last time it attempted (and failed) to breach longstanding resistance at 1.7000. This raises the prospect of a protracted pullback if Sterling struggles to contend with significant resistance at 1.7000.

The Euro regained some ground against the Pound late on Monday but further gains are forecast to be restrained as the single currency remains under significant pressure following last week’s ECB monetary policy meeting.

The Euro also pushed higher against the US Dollar after the International Monetary Fund cut its forecast for U.S. economic growth this year on Monday, saying that the unusually harsh winter, along with the “still-struggling housing market” would act as a drag on growth.

The currency is also likely to soften on Tuesday as the latest ZEW Economic sentiment data for the region is likely to come in weaker than last month.

Events in Ukraine and Iraq are also likely to weigh upon the currency as a further deterioration or escalation in either trouble zone could increase demand for safer haven currencies such as the Japanese Yen and Swiss Franc.

Update 17/06/14

The Pound was holding its gains against the Euro on Tuesday and was able to stay trading above the 1.25 level as comments made by the Bank of England’s governor last week and the deputy governor over the weekend continued to increase speculation that UK interest rates could rise before the end of the year.

The Euro is likely to experience volatility if today’s ZEW economic sentiment data comes in worse than forecast. The Pound too could see movement if today’s inflation rate data disappoints.

Comments are closed.