As the European session opened the Pound was slightly stronger against peers like the US Dollar and Euro as investors digested yesterday’s surprising decline in UK inflation and looked ahead to today’s domestic employment reports.

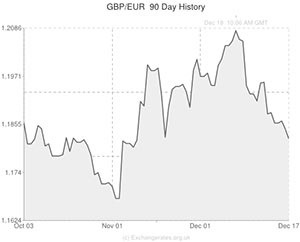

The Pound Sterling to Euro Exchange Rate was in the region of 1.1897 as of 11:00 GMT

The British currency went on to enjoy widespread gains as UK unemployment dropped to its lowest level since 2009.

Although economists had expected the unemployment rate to hold at 7.6 per cent it actually fell to 7.4 per cent in the three months through October as the UK economy added 250,000 positions rather than the 165,000 predicted.

Jobless claims also fell by more than expected in November.

Sterling strengthened against the US Dollar and Euro in the aftermath of the data release, gaining 0.6 per cent on the ‘Greenback’ and moving away from a six-week low against the Euro.

1 Euro is currently worth 0.8404 pence

As London-based industry expert Neil Jones observed; ‘A large drop in the UK unemployment data is revitalising the Pound. The UK will be the first major economy to raise rates. The Pound is outperforming and will continue to do so in 2014.’

That being said, Bank of England Governor Mark Carney did express caution yesterday, reminding the world that ‘nearly 1 million more people are out of work than in the years before the financial crisis, and the economy remains 2.5 per cent smaller than it was in 2008’.

Minutes from the latest BoE meeting also showed that policy makers believe persistent Pound strength could damage the UK’s progress.

Earlier in local trading the Euro had been supported as German business confidence climbed to a twenty-month high, although a steep drop in construction output in the Eurozone tempered the common currency’s strength.

As the day continues further GBP/USD movement is likely to occur as a result of influential US housing data and the Federal Open Market Committee’s highly anticipated policy announcement.

If the Fed decides to trim the level of asset purchases by more than the five billion Dollars forecast by over a third of economists surveyed the Pound’s advance on the ‘Buck’ could prove short lived.

However, if tomorrow’s UK retail sales figures show the expected increase in sales Sterling’s bullish attitude may continue.

Current Pound Sterling (GBP) Exchange Rates:

< Down > Up

The Pound Sterling/US Dollar Exchange Rate is currently in the region of: 1.6354 >

The Pound Sterling/Euro Exchange Rate is currently in the region of: 1.1897 >

The Pound Sterling/Australian Dollar Exchange Rate is currently in the region of: 1.8348 >

The Pound Sterling/New Zealand Dollar Exchange Rate is currently in the region of: 1.9837 >

The US Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.6114 <

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8404 <

The Australian Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5445 <

The New Zealand Dollar/Pound Sterling Exchange Rate is currently in the region of: 0.5042 <

(As of 11:00 GMT)

Comments are closed.