While yesterday’s better-than-forecast UK manufacturing data contributed to Britain’s brightening economic outlook, Pound gains were a little limited ahead Thursday’s Bank of England policy meeting.

Sterling closed Australasian trading slightly lower against the Australian Dollar in spite of the Reserve Bank of Australia commenting that the South Pacific asset remains overvalued.

The central bank opted to leave interest rates and fiscal policy unaltered and restated its commitment to keeping interest rates at record-lows for the foreseeable future.

In this month’s statement RBA Governor Glenn Steven’s repeated remarks issued in February, commenting that ‘On present indications, the most prudent course is likely to be a period of stability in interest rates. The demand for labour has remained weak and, as a result, the rate of unemployment has continued to edge higher.’

Steven’s continued; ‘Resources sector investment spending is set to decline significantly and, at this stage, signs of improvement in investment intentions in other sectors are only tentative. Public spending is scheduled to be subdued […] Dwelling prices have increased significantly over the past year […] The bank expects unemployment to rise further before it peaks. Over time, growth is expected to strengthen, helped by continued low interest rates and the lower exchange rate. Inflation is expected to be consistent with the 2-3 per cent target over the next two years’.

Last month the RBA refrained from referencing the Australian Dollar’s exchange rate and the currency was boosted as a result.

However, this month the central bank returned to its previous stance and asserted that the Australian Dollar ‘remains high by historical standards’.

The ‘Aussie’ consequently declined against peers like the US Dollar and Euro after the announcement.

However, the Australian Dollar continued to hold its own against the Pound and overall declines were limited as separate data showed a narrowing in Australia’s current-account deficit.

The deficit narrowed from 12.5 billion Australian Dollars in the third quarter to 10.1 billion Australian Dollar’s in the fourth. Economists had expected the deficit to decline to 10.0 billion Dollars.

Another report showed that Australian building approvals surged in January, jumping by 6.8 per cent month-on-month rather than climbing the 0.5 per cent expected. December’s decline was positively revised to 1.3 per cent.

This morning a UK report showed that the pace of construction growth slowed by more-than-forecast in February, although the index remained well above the 50 mark separating growth from contraction.

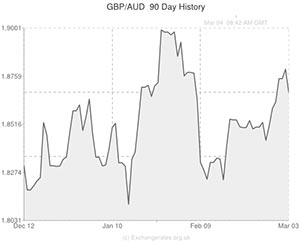

With Australian services and growth data due out tomorrow and UK services PMI scheduled for publication, additional GBP/AUD volatility is certainly on the cards.

Australian Dollar (AUD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Australian Dollar, ,US Dollar, 0.8950,

,US Dollar, 0.8950,

Australian Dollar, ,Euro, 0.6512,

,Euro, 0.6512,

Australian Dollar, ,Pound, 0.5360,

,Pound, 0.5360,

Australian Dollar, ,New Zealand Dollar, 1.0694,

,New Zealand Dollar, 1.0694,

US Dollar, ,Australian Dollar, 1.1192,

,Australian Dollar, 1.1192,

Euro, ,Australian Dollar, 1.5357,

,Australian Dollar, 1.5357,

Pound Sterling, ,Australian Dollar, 1.8649,

,Australian Dollar, 1.8649,

New Zealand Dollar, ,Australian Dollar, 0.9375,

,Australian Dollar, 0.9375,

[/table]

Comments are closed.