Ahead of today’s Eurozone consumer confidence report the Euro declined against several of its major rivals in spite of an encouraging consumer sentiment figure for Germany.

The common currency was feeling the pressure after top ratings agency Standard and Poor’s lowered the European Union’s credit rating and the EUR/USD pairing edged toward a two-week low.

S&P cut the region’s rating from AAA to AA+ with a stable outlook.

While investors often dismiss ratings, S&P’s mentioned the deteriorating creditworthiness of some of the EU member states and this put pressure on the Euro.

S&P stated; ‘EU budgetary negotiations have become more contentious, signalling what we consider to be rising risks to the support of the EU from some member states.’

However, EUR/GBP losses were limited as the Pound came under fire following a surprising decline in UK consumer confidence.

The GfK sentiment measure surprised expectations for improvement by declining from -12 to -13 – an unexpected result given the upbeat UK data published in recent weeks.

As European trading progressed the Euro recovered its footing somewhat thanks to an improved consumer confidence reading for Germany.

Further Euro/Pound gains were enabled as a report showed an increase in the UK’s budget deficit.

With the UK’s deficit expanding from 15.6 billion to 16.5 billion in November (year-on-year) one London-based forex strategist observed; ‘We’re coming out of the recession with an already very wide deficit. Normally we would have expected the deficit to have closed up somewhat but that hasn’t been the case so it does risk the deficit widening out once again. That could be a longer-term drag for Sterling.’

The Pound slipped against the Euro even as the UK kept its top level credit rating with S&P thanks to the nation’s economic recovery surpassing expectations.

S&P observed; ‘Relative to peers, we consider the UK to benefit from higher-than-average fiscal flexibility, meaning that under pressure the government would be willing and able to increase tax pressure and/or cut public spending by at least 3 per cent of GDP in the short term’.

Meanwhile, UK growth data confirmed third-quarter expansion of 0.8 per cent and GDP reports for previous quarters were upwardly revised. The Office for National Statistics figures put year-on-year third quarter growth at 1.9 per cent, better than the 1.5 per cent estimate.

But while the Euro edged higher against the Pound the common currency continued to struggle against the US Dollar as the North American asset enjoyed a bullish relationship with its peers thanks to this week’s FOMC policy announcement.

Further EUR/GBP movement is likely to occur this afternoon as a result of the Eurozone’s consumer confidence report, due out at 15:00 GMT.

Economists have forecast that sentiment in the 17-nation currency bloc improved in December, with the gauge edging up from -15.4 to -15.

Next week the German import price index is the Eurozone’s only piece of economic data.

UK news is also lacking as Christmas fever settles over the Northern hemisphere.

Current Euro (EUR) Exchange Rates

< Lower > Higher

The Euro/US Dollar Exchange Rate is currently in the region of: 1.3660 <

The Euro/Pound Sterling Exchange Rate is currently in the region of: 0.8360 >

The Euro/Australian Dollar Exchange Rate is currently in the region of: 1.5398 <

The Euro/ New Zealand Dollar Exchange Rate is currently in the region of: 1.6716 >

The US Dollar/Euro Exchange Rate is currently in the region of: 0.7329 >

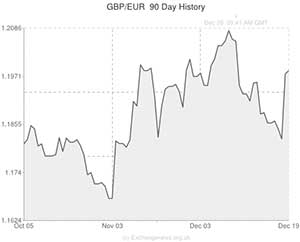

The Pound Sterling /Euro Exchange Rate is currently in the region of: 1.1969 <

The Australian Dollar/Euro Exchange Rate is currently in the region of: 0.6497 >

The New Zealand Dollar/Euro Exchange Rate is currently in the region of: 0.5992 <

(Correct as of 11:50 GMT)

Comments are closed.