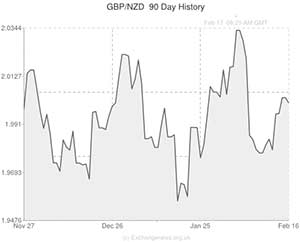

The Pound to New Zealand Dollar exchange rate (GBP/NZD) rallied above 2.0000 during the Asian session as investors reacted to a below-forecast Retail Sales report from the island nation.

Statistics New Zealand announced late last night that domestic Retail Sales volumes increased by 1.2% in the fourth quarter, as 9 out of the15 retail industries reported better sales figures. The ‘Kiwi’ Dollar slid by almost half a cent in a knee-jerk response to the result due to the fact that it was weaker than the median market estimate of 1.7%.

Sterling is currently over 3 cents stronger against the New Zealand Dollar than it was on Wednesday morning. Bank of England Governor Mark Carney’s Quarterly Inflation report, which featured a positive revision to UK GDP and a modification to forward guidance, led to a significant uptick in demand for the Pound. This is because, for the first time, the Bank officially predicted that interest rates will rise by the second quarter of 2015.

Governor Carney released an interview with Andrew Marr from the BBC yesterday in which he stated that persistent weaknesses in Britain’s largest trading partner – the Eurozone – and the large public deficit were two of the strongest arguments against hiking rates, even though Unemployment is now close to the Bank’s initial target rate of 7.0%.

Carney also stated that business investment needs to improve, blaming weak exports on the crisis-stricken currency bloc and the strength of Sterling. He also argued that spare capacity in the economy would not be absorbed, and inflation would fall below target, if the BoE were to raise rates by 150 basis points to 2.00% by the start of 2017 as money markets suggest it will.

“The path of monetary policy, the path of interest rates, is going to be calibrated very carefully to make sure that only once we see sustainable growth in jobs, in incomes and in spending, will we make adjustments”.

The Governor’s attempts to downplay rate hike speculation had very little effect on Sterling, and GBP crosses continued to flourish following the broadcast. It seems that markets anticipate more surprise UK economic indicators to the upside and are therefore under the impression that the Bank will be persuaded to tighten monetary policy earlier than it currently intends to.

This viewpoint is entirely justified. Back in August the BoE predicted that the first rate hike would take place in the second half of 2016; just six months later the Bank has been forced to bring that forecast forward by over a year to Q2 2015. It is certainly possible that policymakers may bring forward their rate hike expectations again at some point in the near future.

In other economic news last night: Japanese GDP printed disappointingly at 1.0% for the year, compared to forecasts of 2.8%, and the Pound to US Dollar exchange rate (GBP/USD) rallied above 1.6800 to reach its highest level since November 2009.

Comments are closed.