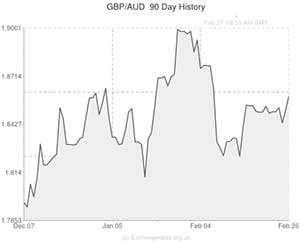

The Pound to Australian Dollar exchange rate (GBP/AUD) surged higher by around 0.8 cents to 1.8680 earlier this morning as markets reacted to a softer-than-expected Australian Private Capital Expenditure figure.

Traders had been primed for a -1.3% decline in expansionary investment, however, the actual Q4 result came in worse – much worse – at -5.2%. The worryingly steep contraction sent GBP/AUD higher instantly as investors grew concerned that the domestic economy is failing to cope with the fallout from the mining boom.

The Private Capital Expenditure indicator, or CAPEX as it is popularly known, is a measurement of the amount of money spent by Australian businesses on products that are designed to boost productivity capacity. During times of robust economic confidence firms are likely to invest more heavily in order to foster future growth. During times of economic hardship or recession business are far less likely to fork out large sums of money because there is a higher risk that output will not accelerate reciprocally.

The Australian Dollar struggled to find support on the currency market following the dismal CAPEX reading and matters were made worse as Qantas Airways announced that it is to slash around 5,000 jobs due to a recent shortfall in earnings. Qantas reportedly lost AU$235 million over the past six months.

The airline intends to save around AU$2 billion from the labour cutbacks and a further AU$1 billion by decreasing capital expenditure over the next two years. With CAPEX suffering heavily declines in the fourth quarter, it is unlikely that we will see an interest rate hike from the Reserve Bank of Australia anytime soon.

GBP/NZD

The Sterling to New Zealand Dollar exchange rate (GBP/NZD) remained fairly flat at 2.0050 last night as a couple of positive news items emerged from the Antipodean nation.

Firstly, the ‘Kiwi’ Dollar garnered support in response to a stronger-than-anticipated Current Account report, which saw the year-to-date surplus rise from –NZ$288 million to NZ$312 million during January. The sturdy figure was helped by a NZ$ 4.08 billion rise in exports, which outperformed a NZ$3.77 billion uptick in imports.

Secondly, demand for the New Zealand Dollar was bolstered by news that Fonterra – New Zealand’s, and the world’s, biggest dairy exporters – upped its forecasts for how much it will pay farmers this year. The 35 cents per kilogram price hike should help boost consumer spending, and this should eventually seep through the real economy, bolstering GDP in the process.

Comments are closed.