The Pound to Australian Dollar exchange rate (GBP/AUD) opened for the week almost a cent higher than it closed on Friday evening due to an abysmal set of Chinese trade figures, which dampened prospects for trade between the two nations.

Compared to expectations of a surplus of $14.50 billion China posted a trade deficit of -$22.98 billion in February, marking the worst score for over two years. In fact it was only the fifth month in the last ten years that the world’s second largest economy failed to sell more than it bought.

Imports held steady at 10.1% whereas Exports plummeted by -18.1%. The worst monthly Export figure since August 2009 shocked investors, who had been primed for a score in the region of +7.5%.

The dismal data negatively impacted the ‘Aussie’ Dollar because China is the largest buyer of Australian goods and raw materials. If Chinese economic output decelerates then it is likely that Chinese manufacturers will tone down their production lines, and therefore will start to import less of Australia’s exports. This will lead to less money entering the Australian economy and therefore less demand for the Australian Dollar.

Disappointing Chinese data also affects the ‘Aussie’ because China’s huge share of the global marketplace is seen to impact risk sentiment. It was also announced over the weekend that Chinese Consumer Prices decelerated from 2.5% to 2.0% during February, which signalled that some areas of economic activity slowed last month.

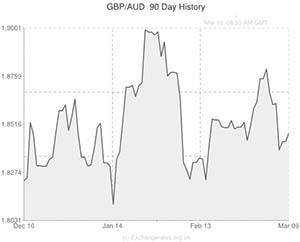

The Sterling to Australian Dollar exchange rate rose from around 1.8430 to 1.8510 when markets reopened for this week’s trading session but GBP/AUD gave back some of its gains during night.

One reason for the fairly mild reaction to the, frankly, terrible Chinese trade figures is that the Chinese New Year Holiday could have had an affect on the report.

According to the General Administration of Customs in China the disappointing reading was heavily influenced by the temporary shutting down of factories and offices for extended periods during the Lunar New Year holiday festival.

At present there are two other external factors contributing to downward pressure on the Australian Dollar: Fed stimulus reduction and the Russia/Ukraine crisis.

On Friday the US Non-farm Payrolls report printed optimistically at 175,000, suggesting that the American labour market is beginning to recover from the polar vortex that brought economic activity to a standstill at the start of the year. The better-than-anticipated jobs data makes it very probable that the Federal Reserve will announce another $10 billion tapering of asset purchases this month. This lessening of stimulus will likely weaken investors’ appetite for risk and therefore demand for the Australian Dollar.

Markets were also worried by Russia’s threat to cut off gas supplies to Ukraine and Europe. The potentially destabilising move could have a profoundly negative impact on European and global economic output and this put traders back into risk aversion mode, which softened the appeal of the risk-sensitive ‘Aussie’.

Comments are closed.