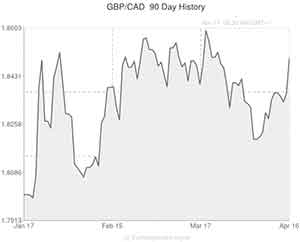

The Pound to Canadian Dollar exchange rate (GBP/CAD) rallied to a fresh 3-week high yesterday as markets reacted to a roster of strong UK labour market data and another spell of dovish rhetoric from the Bank of Canada.

GBP to CAD initially rallied by around 0.8 cents to 1.8440 during the morning when the latest British labour market numbers hit the newswires.

Sterling reacted strongly to news that the headline Unemployment Rate plunged to a 5-year low of 6.9% in February. The figure had only been expected to fall to 7.1%. Investors saw the sharper-than-anticipated fall in joblessness as bullish for the Pound because it could influence the Bank of England to raise interest rates ahead of schedule. Prior to yesterday’s result markets were pricing in a rate hike in Q2 2015, following the report some traders were more inclined to predict a rate rise in Q1 2015.

Although the BoE has since altered its forward guidance policy the original threshold for considering hiking interest rates was 7.0%, and it seems that investors were buoyed by the fact that this level was reached.

The other components of the report also printed positively: Jobless Claims fell by -30,400, bringing the Claimant Count down one notch to 3.4% and Average Weekly Earnings ticked up to 1.7%, indicating that real wages are finally beginning to grow.

Sterling racked up a sizable set of gains against all the majors in reaction to the labour market figures.

However, the Pound’s gains were most notable against the Canadian Dollar. GBP/CAD appreciated by a further 0.6 cents to 1.8500 during the afternoon in reaction to the Bank of Canada’s latest policy decision.

The BoC decided to maintain rates at 1.00%, as expected, but traders were not impressed with Governor Stephen Poloz’s accompanying statement, which was seen to leave the door open to further easing in the future:

“The timing and direction of the next change to the policy rate will depend on…new information”.

This line hurt the ‘Loonie’ because it signalled that future rate cuts are still a possibility if economic conditions do not improve.

Data released later today is predicted to show that Canadian Consumer Prices accelerated from 1.1% to 1.4% last Month. However, if March’s CPI score fails to meet the median forecast then it is possible that the Pound to Canadian Dollar exchange rate (GBP/CAD) could rise towards 1.8600.

Comments are closed.