With the Bank of Canada rate decision looming and US markets closed for Martin Luther King Day, the ‘Loonie’ begins the week bearishly.

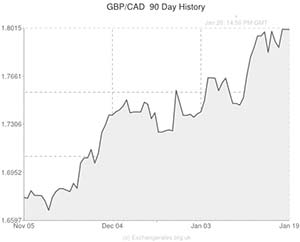

The commodity-driven currency remains close to a four-year low against the US Dollar and was struggling against a strengthening Pound.

After over a year of hinting at the possibility of a rate increase the Bank of Canada did a bit of a U-Turn in the second half of last year and adopted a more dovish stance.

In the wake of several less-than-impressive economic reports for Canada (including the shocking recent employment figure) the odds of the BOC raising interest rates before next year have been falling sharply.

Some economists have even gone so far as to predict a rate cut occurring at some point in the next twelve months.

The ‘Loonie’ has consequently shed nearly 3 cents against its US counterpart in the first few weeks of 2014.

Meanwhile, Sterling has been supported by encouraging UK data (including Friday’s retail sales report) and the prospect of the Bank of England adjusting its fiscal policy sooner than previously forecast.

This morning the Pound was boosted against peers like the ‘Loonie’ as data confirmed that UK house prices climbed in January.

While some industry experts have been extolling the benefits of a weaker Canadian Dollar and highlighting the ways in which the nation’s exporters will benefit, others are less optimistic about the currency’s performance.

According to representatives from the Conference Board of Canada; ‘A declining Loonie will also hit all Canadians in the pocketbook. It makes us all a bit poorer as consumers by increasing the prices for most of the things we import. […] Higher prices would be expected to erode real wage gains, limiting the purchasing power of consumers and slowing real growth in consumer spending, which is the single largest component of GDP.’

Although a slow news day has limited CAD/GBP movement, the pairing is likely to experience volatility as the week continues due to a variety of factors.

While tomorrow’s Canadian wholesale sales and manufacturing shipments reports will be of interests, investors will also be looking ahead to Wednesday’s UK employment figures, the publication of minutes from the latest Bank of England policy meeting and the Bank of Canada’s rate decision.

As the UK data is forecast to show a fall in UK unemployment, if the BOC is as dovish as some expect it to be the Pound could extend gains against the Canadian Dollar.

Canadian retail sales figures will also be of interest, as will Friday’s domestic inflation report.

Canadian Dollar (CAD) Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Canadian Dollar, ,Pound Sterling,0.5562,

,Pound Sterling,0.5562,

Canadian Dollar, ,US Dollar,0.9137 ,

,US Dollar,0.9137 ,

Canadian Dollar, ,Euro,0.6740 ,

,Euro,0.6740 ,

Canadian Dollar, ,Australian Dollar,1.0382 ,

,Australian Dollar,1.0382 ,

Canadian Dollar, ,New Zealand Dollar,1.1049 ,

,New Zealand Dollar,1.1049 ,

US Dollar, ,Canadian Dollar ,1.0952 ,

,Canadian Dollar ,1.0952 ,

Pound Sterling, ,Canadian Dollar,1.7983 ,

,Canadian Dollar,1.7983 ,

Euro, ,Canadian Dollar,1.4831,

,Canadian Dollar,1.4831,

Australian Dollar, ,Canadian Dollar,0.9630,

,Canadian Dollar,0.9630,

New Zealand Dollar, ,Canadian Dollar,0.9047 ,

,Canadian Dollar,0.9047 ,

[/table]

Comments are closed.