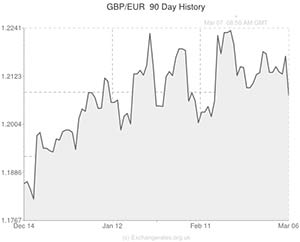

The Pound to Euro exchange rate (GBP/EUR) declined by around a cent yesterday as markets reacted to the European Central Bank’s decision not to introduce further stimulus.

Investors, who had been primed for a €175 billion boost to the banking sector from ‘sterilized’ Securities Market Programme (SMP) funds, took Sterling down from 1.2180 to 1.2080 yesterday following the ECB announcement.

The Bank voted against reducing the benchmark interest rate from its current record low of 0.25% and policymakers also decided against taking the deposit rate into, unknown, negative territory. This much was expected, and therefore had a limited impact on the Euro exchange rate.

The Bank of England also opted to remain on the sidelines inline with market predictions. The headline interest rate remained at 0.50% and the QE target was left unchanged at £375 billion.

Traders were influenced to a greater extent by ECB President Mario Draghi’s policy statement, in which Draghi made it clear that he does not intend to increase stimulus measures unless economic conditions deteriorate:

“The suspension of sterilization…is one of the instruments that is in our list but we didn’t see any development in the money markets that would lead to that unwanted tightening of monetary conditions that would justify the use of this instrument”.

Draghi also added that the benefits of suspending sterilization would likely only last for one year.

However, with excess liquidity in the Eurozone banking system now standing at just €144 billion, which is around the same level that it was back in 2011 when the ECB unleashed its LTRO liquidity-boosting scheme, it is debatable whether the Bank was correct to hold back on stimulus.

Former ECB advisor Francesco Papaida bemoaned the Bank’s lack of forward thinking and argued that it should act decisively now to prevent deflation kicking in, rather than later on when it is too late:

“The ECB has stopped being forward looking, it risks acting only when it will be too late and expectations are no longer anchored”.

With CPI inflation not set to reach the Bank’s 2.0% target until 2017 at the earliest – even by the ECB’s own calculations – it is easy to see why some analysts were not happy with yesterday’s decision.

Any further stimulus measures in the future would likely weaken the single currency, either by reducing the yield value on assets denominated in Euros or by increasing the money supply. This could potentially benefit the currency bloc by increasing the competitiveness of the Eurozone’s exports.

Whether wise or short-sighted, the ECB’s policy statement means that the single currency should remain sure-footed against Sterling for the rest of the month.

Comments are closed.