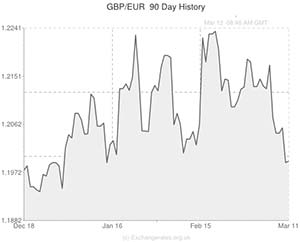

The Pound to Euro exchange rate (GBP/EUR) tumbled below key psychological support at 1.2000 last Monday and has not been above that level since.

The catalyst for Sterling’s decline was the announcement from the European Central Bank on Thursday 6th March that policymakers did not see a sufficient threat of deflation to loosen monetary policy at this juncture. Prior to the announcement GBP to EUR had traded close to yearly highs above 1.2200.

Eurozone CPI inflation printed at 0.7% for February yesterday, marking a downward revision from previous estimates of 0.8%. With deflation concerns proving to be the heaviest weight on the Euro recently, it would be expected that a disappointing Consumer Price Index reading would diminish demand for the single currency. However, markets reacted with a surprising level of disinterest; within a couple of hours of the CPI print the Pound to Euro exchange rate was actually around 20 pips weaker.

This shows that investors have taken note of the ECB/Bundesbank’s reluctance to inject any fresh monetary stimulus into the Eurozone economy. Furthermore, it means that inflation will have to fall to a fresh 4-year low of 0.6% or less before markets start to worry about the threat of ECB easing due to soft CPI again.

Last Thursday the Euro to US Dollar exchange rate (EUR/USD) struck a 2-year high of 1.3966 and shortly afterwards ECB President Mario Draghi gave a speech in which he talked down the value of the Euro. This could be a hint that the Bank is not willing to let the Euro surpass 1.4000 against the ‘Greenback’. If this is the case then it creates another scenario in which the single currency could be hampered by fresh stimulus.

Later this morning the German Economic Sentiment ZEW survey is predicted to print at 52.0 for March, down from 55.7 in February. The result is unlikely to have a massive impact on the currency market though, because it carries a significantly smaller importance than the Consumer Price Index.

The next key moment for GBP/EUR is set to be Wednesday’s UK Unemployment Rate reading. Analysts predict that the jobless rate held steady at 7.2% during January, but with recent PMI surveys showing record growth in job creation it is distinctly possible that the labour market report could give the Pound a bullish boost.

Although anything north of 6.5% would probably not budge the BoE from hiking rates next spring, any score below the 7.2% consensus would probably bolster demand for Sterling due to a swelling of rate hike speculation.

The Bank of England is also set to release the Minutes from its latest meeting on Wednesday morning. The report is expected to show that the majority of policymakers are confident that the slack currently present within the British economy will be reduced by this time next year. Whilst this kind of modestly positive sentiment may not have a massive bullish impact on Sterling, it is likely to aid any GBP/EUR rallies above 1.2000.

Basically, in lieu of a drastic drop in Eurozone CPI inflation, it will take a EUR/USD rate above 1.4000 or a decline in the British Unemployment Rate to push GBP/EUR back above 1.2000 in the near term.

Comments are closed.