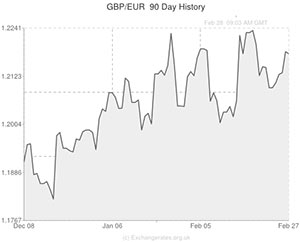

The Pound to Euro exchange rate (GBP/EUR) struggled to surpass psychological resistance at 1.2200 yesterday despite a disappointing German data print showing that inflation slowed unexpectedly during February.

The latest German Consumer Price Index report communicated that price pressures receded from 1.3% to 1.2% this month, confounding predictions that inflation had not slowed. Perhaps more worryingly, the EU-harmonised index decelerated from 1.2% to 1.0% in February.

As the Eurozone’s biggest and therefore most influential economy, Germany has a massive impact on the performance of the currency zone as a whole. Subsequently, yesterday’s surprise inflation slowdown bodes badly for this morning’s Eurozone CPI reading.

Inflation in the currency bloc is expected to have slowed from 0.8% to 0.7% during February. If the Consumer Price Index comes in at that level then it will pile more pressure on the European Central Bank to ease monetary policy further in order to prevent the currency bloc descending into a deflationary spiral; the pressure will be even greater if the CPI print comes in below the market consensus.

Earlier this week the ECB made it clear that policymakers will be assessing up-and-coming inflation data to decide whether it needs to provide fresh stimulus. The Bank will decide, and announce, whether it views the currency bloc’s inflationary outlook to be soft enough to warrant further easing measures at its next meeting on March 6th.

GBP/EUR is liable to fluctuate to the beat of inflation/stimulus expectations drum between now and March 6th.

In other news related to the Pound to Euro exchange rate yesterday: the single currency benefitted from an encouraging -14,000 fall in the number of people out of work in Germany – the Unemployment Rate remained upbeat at 6.8% – and the Pound was subject to some mild selling pressure as Bank of England policymaker David Miles commented that UK interest rates may “never” return to their long-term average of 5.00%, due to the lasting impact of the global financial crisis of 2008.

GBP/USD

The Pound to US Dollar exchange rate (GBP/USD) advanced slightly yesterday to 1.6690 as markets reacted to comments from Federal Reserve President Janet Yellen. The recently appointed ‘head of Fed’ commented on the recent downturn in US economic data:

“A number of data releases have pointed to softer spending than many analysts had expected. Part of that softness may reflect adverse weather conditions. But at this point it is difficult to discern exactly how much”.

Traders interpreted the comments as a warning against complacency: essentially a warning that the polar vortex may not be completely culpable for the recent slowdown.

Although Yellen asserted that the Central Bank will “likely reduce the pace of asset purchases in further measured steps at future meetings”, markets were ever-so-slightly more expectant of stimulus continuing for a little while longer following the statement and this weakened the US Dollar.

Comments are closed.