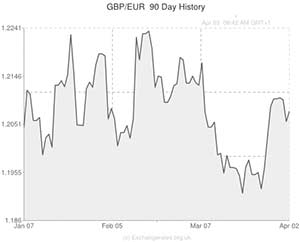

The Pound to Euro exchange rate (GBP/EUR) rose by around a third of a cent to 1.2080 yesterday as investors reacted to some sturdy UK Construction numbers and some worrying Eurozone Producer Price figures.

British Construction printed at 62.5 in March, slightly lower than February’s 63.0, but the report was interpreted as fairly bullish for the Pound because job creation remained close to 7-year highs and business optimism did rise to a new 7-year high.

The Pound also garnered support from a robust UK housing market report indicating that the average British house price increased by 9.2% over the last twelve months. Despite fears that ultra low interest rates and government schemes such as Help to Buy could be fuelling another property bubble, the rapidly expanded housing sector is likely to drive Construction activity higher over the next year, as evidenced in the upbeat PMI report.

In the Eurozone the story was very different. The only significant data release of the day showed that factory output prices tumbled by another -0.2% during February, bringing the annual PPI down by -1.7%. Although energy prices were largely to blame for the decline, Producer Prices were still down -0.5% even with energy costs stripped from the report.

With CPI inflation currently at a 4-year low of just 0.5% and PPI already running in negative territory at -1.7%, it looks as if deflation concerns are unlikely to go away anytime soon.

Despite this soft inflationary outlook, the European Central Bank has remained fairly reluctant to introduce further monetary stimulus. The ECB did cut the benchmark interest rate from 0.50% to 0.25% back in November, but since then no further monetary loosening has taken place.

The majority of market players do not expect the ECB to announce any fresh stimulus this afternoon, however, recent comments from policymakers have suggested that some officials at the Bank are ready to act to prevent deflation from spreading.

If the European Central Bank does act it will most likely be in the form of another interest rate cut, an introduction of negative deposit rates or in the form of quantitative easing. Any of these three options could seriously damage sentiment towards the single currency and could send GBP to Euro back above 1.2100 towards 1.2200.

Data this morning is predicted to show that the UK Service Sector remained strong at 58.1 during March, which should bolster demand for Sterling as long as job creation numbers continue to impress.

Eurozone Retail Sales are expected to have risen by 0.8% during February but, unless there is a significantly higher or massively lower sales figure, Euro trading will probably be dictated by the ECB policy decision.

Comments are closed.