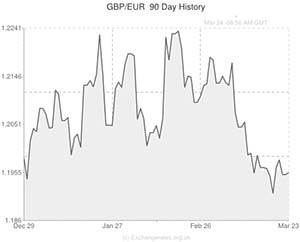

As a new week of trading got underway the Pound to Euro pairing was struggling as the appeal of the Pound declined and patchy PMI data lent some support to the Euro.

The Bank of England’s united stance on the necessity of holding interest rates at record lows for the foreseeable future piled pressure on Sterling and pushed the currency to as low as 84 pence per Euro last week.

A lack of UK news on Monday meant that movement in the GBP/EUR exchange rate was the result of Eurozone data, and while today’s economic reports for the currency bloc were a little hit-and-miss there were positives to be observed.

The Markit PMI reports showed that the services and manufacturing sectors of France (the Eurozone’s second largest economy) returned to growth in March.

The services index achieved a 26-month high of 51.4 while the manufacturing measure rose to a 34-month high of 52.8.

In a statement published with the figures Markit economist Jack Kennedy observed; ‘Much-improved PMI data in March indicate that the private sector is moving in the right direction, with activity, new business and backlogs all returning to growth. […] If activity growth can gain some traction in the coming months then we could also see some improvement on the employment front, which would deliver a timely boost to confidence.’

Meanwhile, Germany’s services/manufacturing measures held above the 50 mark separating growth from contraction (although they came in a little below estimate) and the Eurozone’s services growth remained close to its highest level since 2011.

Eurozone manufacturing PMI slipped from 53.2 to 53.0 while services PMI held at 52.6 in March.

Eurozone composite PMI was down slightly from 53.3 in February to 53.2 in March.

However, Euro gains were limited as the PMI data stressed the danger posed to the Eurozone by falling prices.

Markit economist Chris Williamson noted; ‘Policymakers will be encouraged by the survey in terms of the signs of a sustained recovery. However, concerns will persist regarding the deflationary forces, especially in the periphery. With prices charged by manufacturers and service providers both falling again in March, there remains an argument for further stimulus, especially if the rate of growth of activity cools again in April.’

If tomorrow’s IFO German business climate/current assessment/expectations reports surprise to the upside the Euro could post gains against peers like the Pound and US Dollar.

GBP to Euro movement is also likely to be inspired by UK inflation figures.

Euro Exchange Rates

[table width=”100%” colwidth=”50|50|50|50|50″ colalign=”left|left|left|left|left”]

Currency, ,Currency,Rate ,

Euro, ,Pound Sterling,0.8358,

,Pound Sterling,0.8358,

Euro, ,US Dollar,1.3800,

,US Dollar,1.3800,

Euro, ,Canadian Dollar,1.5471,

,Canadian Dollar,1.5471,

Euro, ,Australian Dollar,1.5148,

,Australian Dollar,1.5148,

Euro, ,New Zealand Dollar,1.6197 ,

,New Zealand Dollar,1.6197 ,

US Dollar, ,Euro ,0.7254,

,Euro ,0.7254,

Pound Sterling, ,Euro,1.1961,

,Euro,1.1961,

Canadian Dollar, ,Euro,0.6462,

,Euro,0.6462,

Australian Dollar, ,Euro,0.6606,

,Euro,0.6606,

New Zealand Dollar, ,Euro,0.6179 ,

,Euro,0.6179 ,

[/table]

Comments are closed.