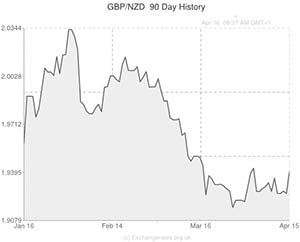

The Pound to New Zealand Dollar exchange rate (GBP/NZD) jumped higher by half a cent late last night in response to a softer-than-expected New Zealand CPI inflation reading of 1.5%.

The report showed that, despite expectations of 0.5%, Consumer Prices only rose by 0.3% in the first quarter compared to the fourth quarter last year. On an annual basis the inflation barometer decelerated from 1.6% to 1.5%, missing expectations of a rise to 1.7%.

The disappointing data release had an immediate impact during the Asian session, with GBP to NZD initially rallying by over around a cent in the immediate aftermath. The cooling of inflation pressures weakened demand for the ‘Kiwi’ Dollar because it was seen to reduce the probability that the Reserve Bank of New Zealand will raise interest rates again later this month.

However, the RBNZ has been forthright in asserting that it intends to hike rates fairly rapidly through 2014; indeed the Central Bank began this process with a 25 basis point rise earlier in the year. Sterling’s gains were trimmed to just half a cent as investors digested the data and, for the most part, concluded that an RBNZ rate hike is still fairly likely this month.

Earlier on in the day the Pound had suffered a slight blip due to the lowest UK CPI inflation figure since 2009. But Sterling remained buoyant ahead of this morning’s key labour market report, which is anticipated to signal the first rise in real wages since 2010.

Encouragingly, the report is also likely to feature a reduction in the headline Unemployment Rate from 7.2% to 7.1% and a drop in the Claimant Count from 3.5% to 3.4%.

If the data prints as it is expected to then it could give Sterling a sizeable boost on the currency market.

GBP/USD is currently around a cent off a 4-year high and GBP/EUR is trading close to 13-month highs. Later today the US Dollar could receive a boost if US Industrial Production comes in positively, however, the single currency is unlikely to garner much support if Eurozone CPI remains at a 4-year low of 0.5% inline with the market forecast.

Another important item on the agenda today is the Bank of Canada’s rate decision; the BoC is widely expected to hold interest rates at 1.00% but Governor Stephen Poloz’s press conference will be scoured for signs of future rate movements. The ‘Loonie’ put in a bearish day against the Pound yesterday with GBP/CAD appreciating by just over a third of a cent despite a positive Canadian Existing Home Sales print of 1.0% and a sturdy Canadian Manufacturing Sales score of 1.4%. It is never a good sign to see a currency fall on positive data.

Comments are closed.