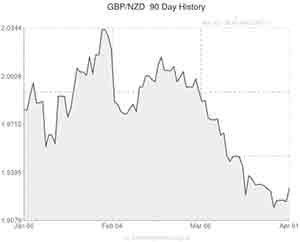

The Pound to New Zealand Dollar exchange rate (GBP/NZD) rallied through technical resistance at 1.9220 late last night to breach the 1.9300 handle as investors responded to data showing that dairy prices tumbled by -8.9% over the last fortnight.

New Zealand’s Fonterra Co-operative Group is the world’s largest exporter of dairy products and the company accounts for around 30% of the nation’s total exports. For this reason any price plunges can be interpreted as dovish for the ‘Kiwi’ Dollar because they indicate that less money will be transferred into the country in any given month.

The latest data from Fonterra, relating to a bi-monthly auction that took place yesterday, showed that prices stumped by -8.9% over the last fortnight. The disappointing slide marked the fourth consecutive time that prices have fallen over the last few months, raising concerns that New Zealand’s most important commodity could be falling into a downward spiral. The fact that the declines have become steeper at each of the last four auctions merely exasperates this viewpoint. As did a report released earlier this morning from ANZ showing that its Commodity Price Index dipped -0.1% in March.

Earlier on in the day yesterday the Sterling to New Zealand Dollar exchange rate (GBP/NZD) was influenced by mixture of contrasting economic indicators.

Firstly, GBP/NZD tumbled below 1.9200 in reaction to a mild improvement in the official Chinese Manufacturing PMI ecostat, which printed at 50.3 in March up from 50.2 in February. The impact of the figure was fairly limited because investors had been hoping for a stronger rebound following the disruption of the Chinese New Year.

Secondly, Sterling rose back above 1.9200 against the risk-sensitive ‘Kiwi’ as HSBC/Markit’s unofficial PMI reading came in significantly lower than the official figure, at 48.0 in March down from 48.5 in February. The unofficial report processes the output of private companies and is seen as a more objective measure of factory activity in the world’s second largest economy. The soft figure hurt investors’ appetite for risk.

Finally, the Pound sunk to a daily low of 1.9138 as markets reacted to a slightly lower-than-forecast UK Manufacturing activity reading. The British Purchasing Managers Index fell unexpectedly from 56.2 to 55.3 during March, however, the New Zealand Dollar was unable to hold onto its gains for long as traders digested the details of the report, which indicated that job creation and consumer production both remained very strong last month.

Comments are closed.