The Pound to New Zealand Dollar exchange rate remains close to a monthly high ahead of this morning’s key UK Q1 GDP report.

Data late last night showed that both Exports and Imports rose by more than expected in New Zealand during March, bringing the annual Trade Balance up to NZ$0.8 billion from NZ$0.65 billion. Although the trade figures were slightly more encouraging than anticipated, the difference between the forecasts and the actual results were minimal and subsequently GBP/NZD volatility remained muted.

The Office for National Statistics (ONS) is expected to announce later this morning that the British economy expanded at a quarterly rate of 0.9% during the first three months of the year, which would mark a steady improvement on the 0.7% expansion registered in the fourth quarter of 2013. On an annual basis GDP output is anticipated to have grown by a whopping 3.2%, which is remarkable considering that yearly British growth has not surpassed the 3.0% mark since 2008.

If the data prints as expected – and this is a big IF – then it is possible that Sterling could rally further against the New Zealand Dollar this week.

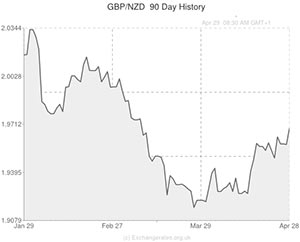

GBP/NZD is almost ten cents below the 1.5 year high of 2.0434 that it struck back in January, and it is difficult to see the Pound reaching those levels again anytime soon due to the Reserve Bank of New Zealand’s recent 50 basis point rise in interest rates, however, it is conceivable that Sterling could attempt to breach psychological resistance at 2.0000.

This is because data due out of the United States this week has the potential to boost Fed rate hike bets, which in turn has the potential to damage global risk sentiment.

The Federal Reserve is likely to announce another -$10 billion tapering of asset purchases on Wednesday evening and the prospect of an earlier-than-expected interest rate rise could improve if Friday’s Non-farm Payroll prints positively.

Markets forecast a score of 210,000 for April, which in itself would be seen as a bullish signal and would bring the headline Unemployment Rate down to 6.6%. Anything north of 210,000 could be seen as even more impressive and could have an even greater impact on Fed rate projections.

The risk-sensitive New Zealand Dollar is often bought by traders for its relatively high yield value – indeed the RBNZ’s 3.00% interest rate is much higher than any of the other major Central Banks – but the ‘Kiwi’ also tends to depreciate when investors are worried that borrowing rates are about to be raised.

The Fed’s expansive stimulus scheme has boosted financial markets across the globe over the past few years but, if traders start to anticipate an end to cheap money, it is possible that perceived riskier assets could begin to slide.

Comments are closed.